Post by Blitz on Oct 23, 2024 7:30:53 GMT -5

Macau GGR to increase 5% YoY in 4Q24: CICC

Viviana Chan - October 23, 2024

agbrief.com/intel/deep-dive/23/10/2024/macau-ggr-to-increase-5-yoy-in-4q24-cicc/

Investment bank China International Capital Corporation (CICC) is optimistic about the growth of Macau’s gaming industry in the fourth quarter of 2024. Analysts predict a quarter-on-quarter increase of 4 percent and a year-on-year increase of 5 percent in total gross gaming revenue (GGR).

CICC’s report highlights several key factors supporting this anticipated growth. First, the appreciation of the Renminbi against the Hong Kong Dollar is expected to attract more visitors and enhance their spending capacity. Second, consumer confidence is projected to strengthen in 4Q24, bolstered by a series of stimulus policies introduced by the Chinese government.

Additionally, non-gaming activities, such as the Andy Lau concert, are likely to boost visitor numbers. However, industry growth might face slight challenges from travel restrictions during the 25th-anniversary celebrations of the Macau SAR. According to local media reports, President Xi Jinping may attend the celebrations, which could lead some visitors to avoid traveling during that period. Macau’s anniversary falls on December 20th, which is a public holiday in the region.

CICC’s expectations align with those of local tourism authorities, who anticipate a busy event schedule in the fourth quarter, along with the Christmas holidays, typically a peak season for tourism.

In June, Macau’s tourism authorities set a goal to welcome 33 million visitors in 2024, representing a nearly 17 percent increase from 2023. This projection is based on the fact that the Chinese government has added 10 more cities to the Individual Visit Scheme (IVS).

Galaxy Entertainment, Macau, Capella Hotel

Galaxy is a top pick

CICC reaffirms a “buy” rating on several stocks, including Galaxy Entertainment, bolstered by the continued ramp-up of Galaxy Phase 3 and the planned mid-2025 opening of the Galaxy Capella Hotel, featuring 36 sky villas and 57 suites.

Wynn Macau is also highlighted, as the company possesses ‘top-tier customer resources’, potentially allowing it to benefit more from the wealth effect compared to its peers.

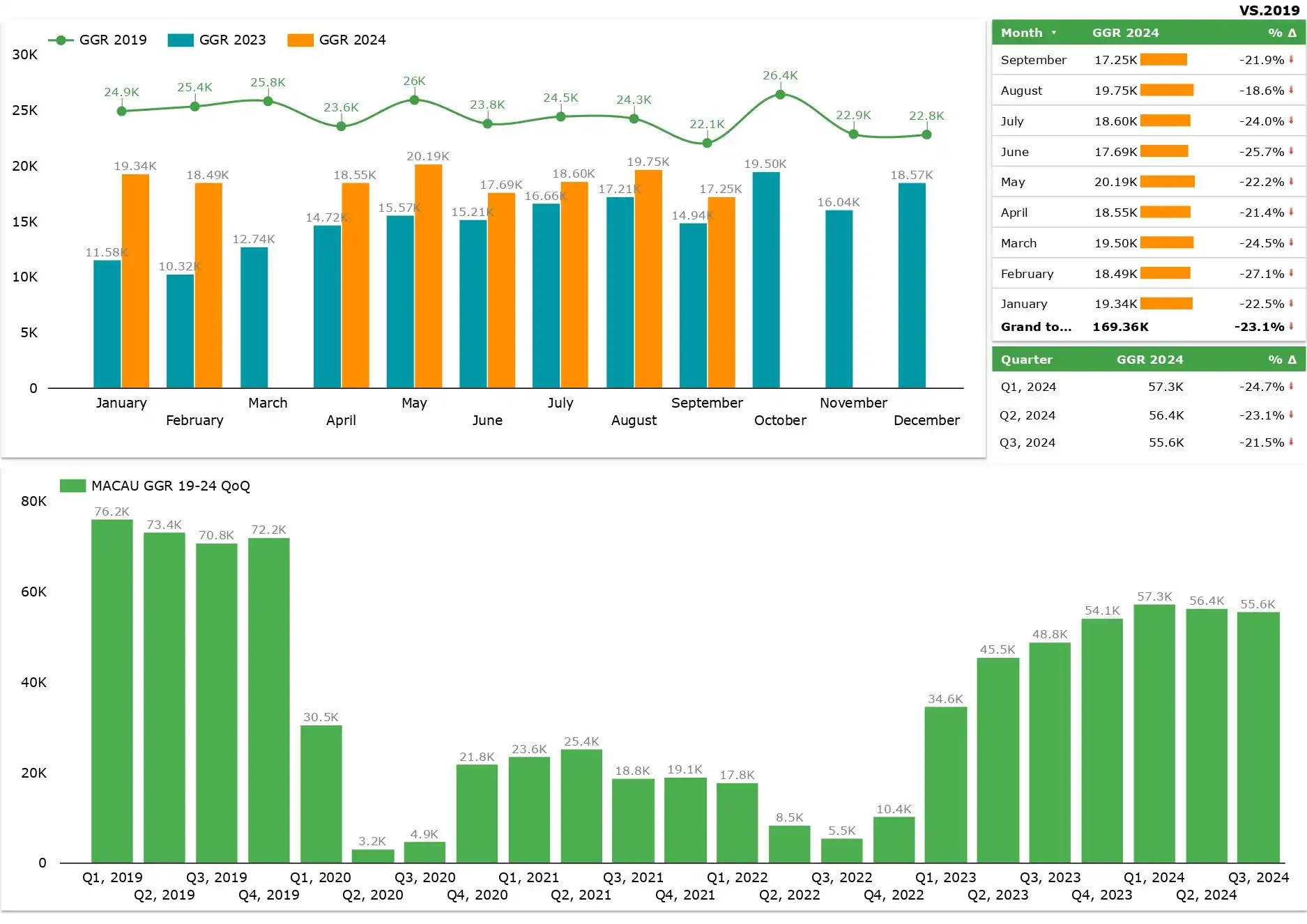

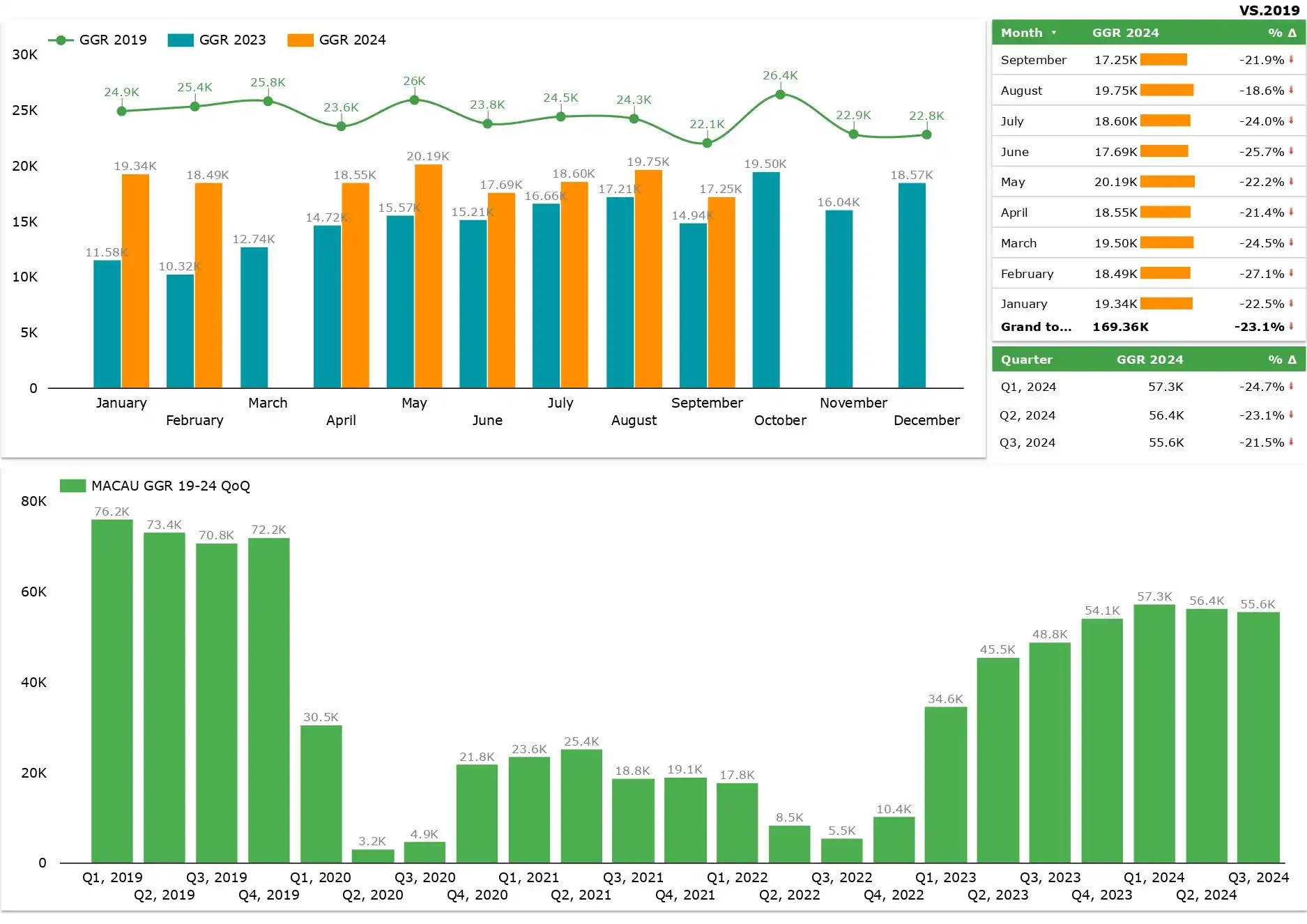

Data from the Gaming Inspection and Coordination Bureau (DICJ) of Macau show that total gross gaming revenue for 3Q24 increased by 13.9 percent year-on-year but decreased by 1.5 percent quarter-on-quarter, reaching 78.5 percent of 3Q19’s total.

MACAU September GGR-2024

The mass gaming sector saw a slight quarter-on-quarter decline of 1 percent, recovering to 107 percent of 3Q19 levels. Meanwhile, the VIP sector experienced a 3 percent decline quarter-on-quarter, recovering to just 42 percent of Q3 2019 levels.

CICC forecasts a 5 percent year-on-year increase in industry EBITDA for 3Q24, but a 2 percent decrease quarter-on-quarter, amounting to $1.93 billion and recovering to 83 percent of 3Q19 levels.

This projection takes into account the slightly weak performance of total gaming revenue, although the reinvestment rate within the industry remains stable.

For the Macau gaming industry, based on adjustments to revenue forecasts, CICC has lowered industry EBITDA predictions for 2024 and 2025 by 2 percent and 6 percent, respectively, expecting a recovery to 86 percent and 97 percent of 2019 levels.

Meanwhile, analysts also note that the recovery of the Macau gaming industry is slower than expected, and competition in the Asian gaming market is intensifying.

Viviana Chan - October 23, 2024

agbrief.com/intel/deep-dive/23/10/2024/macau-ggr-to-increase-5-yoy-in-4q24-cicc/

Investment bank China International Capital Corporation (CICC) is optimistic about the growth of Macau’s gaming industry in the fourth quarter of 2024. Analysts predict a quarter-on-quarter increase of 4 percent and a year-on-year increase of 5 percent in total gross gaming revenue (GGR).

CICC’s report highlights several key factors supporting this anticipated growth. First, the appreciation of the Renminbi against the Hong Kong Dollar is expected to attract more visitors and enhance their spending capacity. Second, consumer confidence is projected to strengthen in 4Q24, bolstered by a series of stimulus policies introduced by the Chinese government.

Additionally, non-gaming activities, such as the Andy Lau concert, are likely to boost visitor numbers. However, industry growth might face slight challenges from travel restrictions during the 25th-anniversary celebrations of the Macau SAR. According to local media reports, President Xi Jinping may attend the celebrations, which could lead some visitors to avoid traveling during that period. Macau’s anniversary falls on December 20th, which is a public holiday in the region.

CICC’s expectations align with those of local tourism authorities, who anticipate a busy event schedule in the fourth quarter, along with the Christmas holidays, typically a peak season for tourism.

In June, Macau’s tourism authorities set a goal to welcome 33 million visitors in 2024, representing a nearly 17 percent increase from 2023. This projection is based on the fact that the Chinese government has added 10 more cities to the Individual Visit Scheme (IVS).

Galaxy Entertainment, Macau, Capella Hotel

Galaxy is a top pick

CICC reaffirms a “buy” rating on several stocks, including Galaxy Entertainment, bolstered by the continued ramp-up of Galaxy Phase 3 and the planned mid-2025 opening of the Galaxy Capella Hotel, featuring 36 sky villas and 57 suites.

Wynn Macau is also highlighted, as the company possesses ‘top-tier customer resources’, potentially allowing it to benefit more from the wealth effect compared to its peers.

Data from the Gaming Inspection and Coordination Bureau (DICJ) of Macau show that total gross gaming revenue for 3Q24 increased by 13.9 percent year-on-year but decreased by 1.5 percent quarter-on-quarter, reaching 78.5 percent of 3Q19’s total.

MACAU September GGR-2024

The mass gaming sector saw a slight quarter-on-quarter decline of 1 percent, recovering to 107 percent of 3Q19 levels. Meanwhile, the VIP sector experienced a 3 percent decline quarter-on-quarter, recovering to just 42 percent of Q3 2019 levels.

CICC forecasts a 5 percent year-on-year increase in industry EBITDA for 3Q24, but a 2 percent decrease quarter-on-quarter, amounting to $1.93 billion and recovering to 83 percent of 3Q19 levels.

This projection takes into account the slightly weak performance of total gaming revenue, although the reinvestment rate within the industry remains stable.

For the Macau gaming industry, based on adjustments to revenue forecasts, CICC has lowered industry EBITDA predictions for 2024 and 2025 by 2 percent and 6 percent, respectively, expecting a recovery to 86 percent and 97 percent of 2019 levels.

Meanwhile, analysts also note that the recovery of the Macau gaming industry is slower than expected, and competition in the Asian gaming market is intensifying.