Post by Blitz on Jun 27, 2024 6:48:12 GMT -5

Macau gaming struggles to return to pre-COVID heights as growth factors disappear: Study

By Viviana Chan - June 27, 2024

agbrief.com/news/macau/27/06/2024/macau-gaming-struggles-to-return-to-pre-covid-heights-as-growth-factors-disappear-study/

A new paper on the post-pandemic reality of Macau’s gaming industry states that while the current situation is favorable, returning to pre-pandemic heights will be challenging. The main reason is that the factors that once drove Macau’s rapid growth are disappearing.

Wang Changbin,Director of the Center for Gaming and Tourism Studies, MPU

Published in the latest edition of Macau Polytechnic University’s (MPU) Global Gaming & Tourism Research, the study authored by Wang Changbin, director of the Center for Gaming and Tourism Studies, emphasizes that gaming in Macau has entered a new, less prominent era compared to the meteoric expansions of the 2000s and 2010s.

Wang Changbin indicates that the international situation is becoming increasingly complex, with frequent natural and man-made disasters hindering people’s willingness to travel. He also mentions that neighboring countries are continually opening casinos near China’s borders and taking various measures to attract Chinese residents.

Mainland China generally opposes its residents gambling abroad and has strengthened border control measures accordingly. Additionally, due to limited land resources, it is difficult for Macau to build new entertainment venues, reducing the allure of ‘new venues’ for tourists.

Wang also recalls that before the pandemic, a significant portion of Macau’s gaming revenue came from third-party VIP rooms. However, due to changes in China’s criminal law that severely crack down on junkets organizing Chinese citizens to gamble abroad, these junkets now face significant legal risks in bringing mainland VIP guests to Macau.

‘As a result, most gaming promoters have stopped promoting in the mainland, leading to a sharp decline in gaming revenue from third-party VIP rooms, dropping from 55 percent in 2018 to 24 percent in 2022. While junkets are actively seeking new clients from other regions, it will take time to see significant results.’

Additionally, as other Southeast Asian countries are also actively developing their gaming industries, there is fierce competition for clients from these regions. In the long term, it will be increasingly difficult for junkets to attract affluent individuals from outside Macau to participate in gaming activities.

Shift to mass market

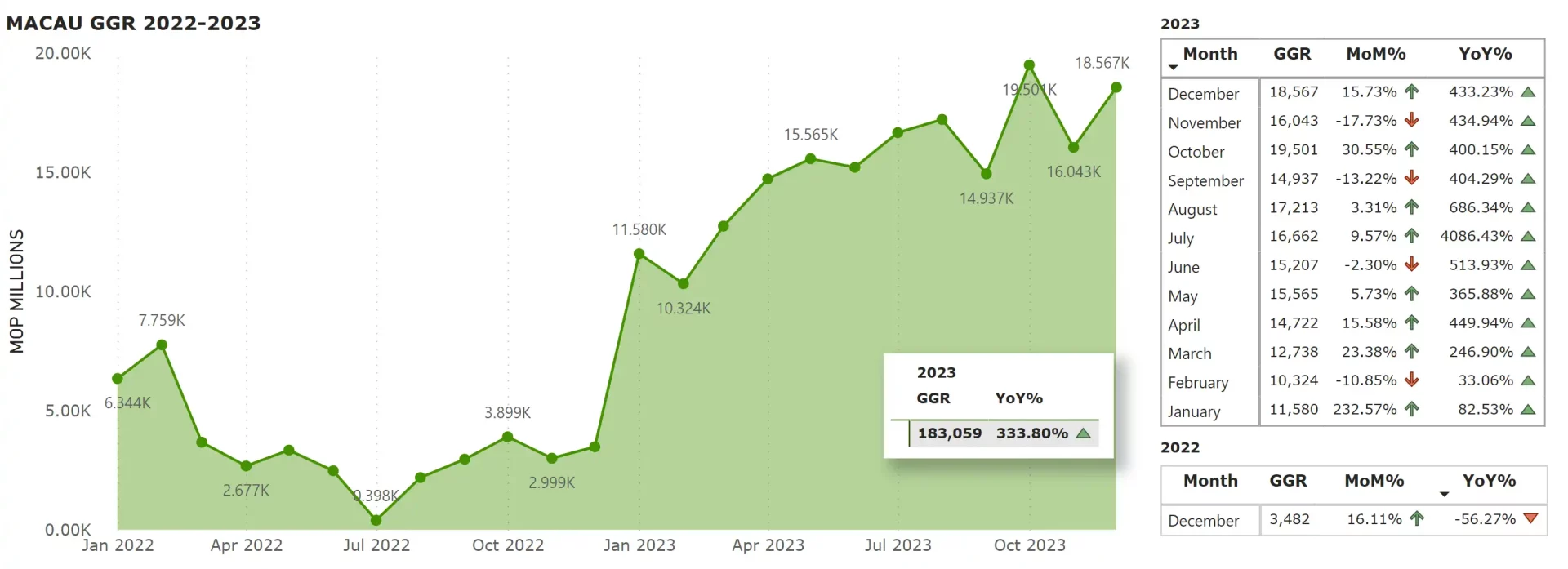

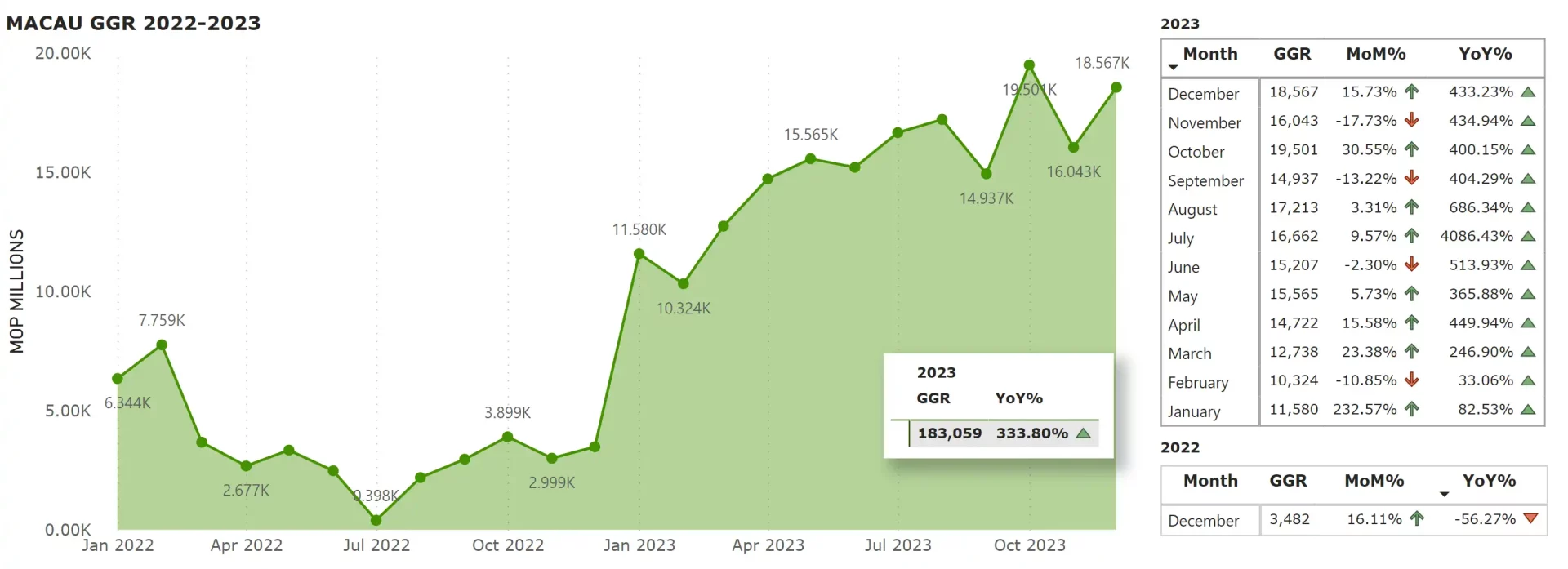

The gaming scholar from the Center for Gaming and Tourism Studies notes that the composition of gaming revenue has significantly changed, with a substantial decrease in VIP revenue. In 2019, the total gross gaming revenue was MOP292.5 billion ($36.4 billion), with revenue from VIP segment accounting for MOP135.2 billion ($16.8 billion), or 46.2 percent.

In 2023, the total gross gaming revenue (GGR) was MOP183.1 billion ($22.8 billion), with VIP at MOP45.2 billion ($5.6 billion), dropping to 24.7 percent.

Macau GGR, December 2023

Gaming revenue has maintained at 60-80 percent of the 2019 level, with the majority coming from the mass market. ‘This situation is likely to become the new normal for Macau’s gaming industry in the coming years. Since these changes occurred at the legal level rather than due to short-term policies, they will have long-term effects, making substantial changes unlikely in the next few years.’

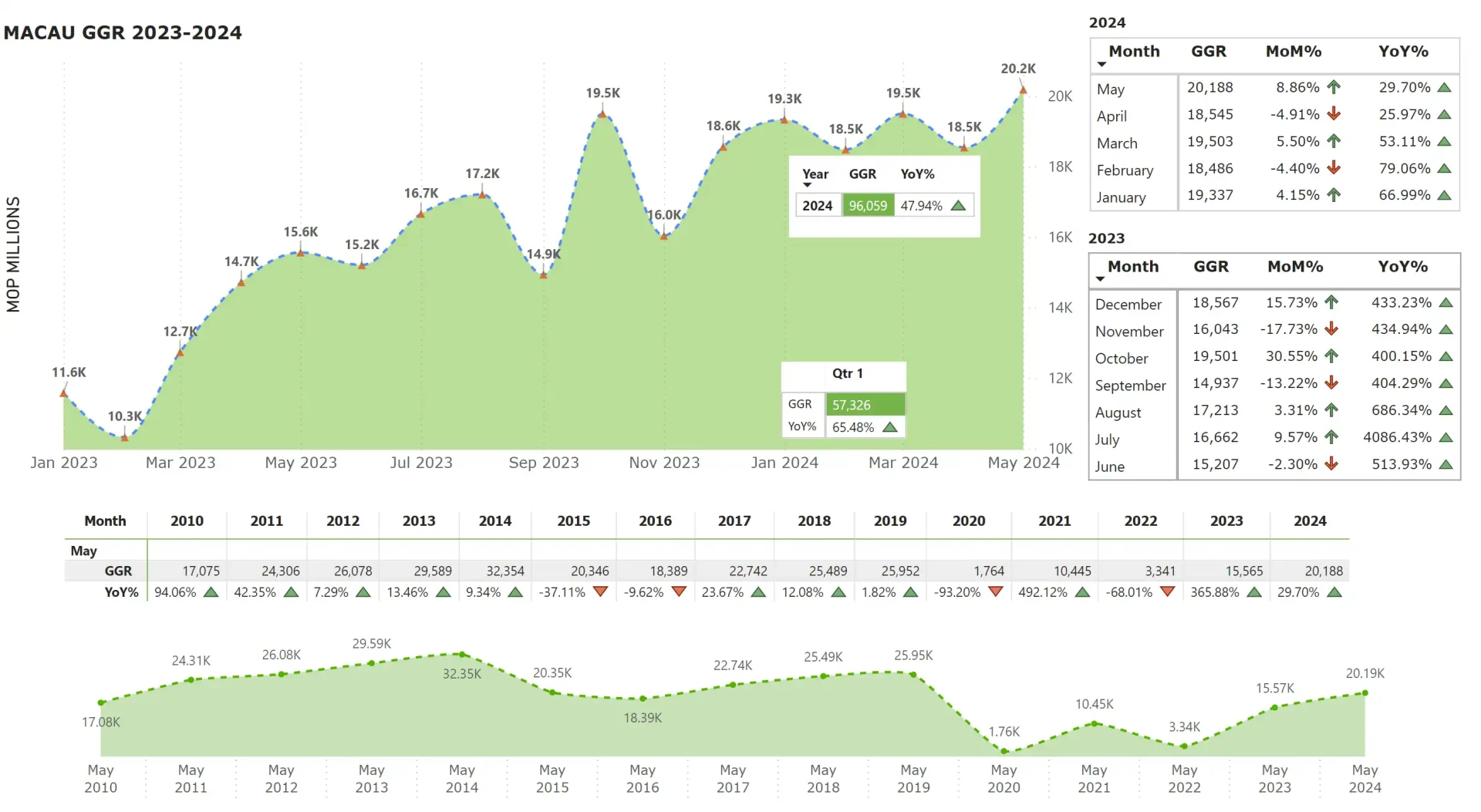

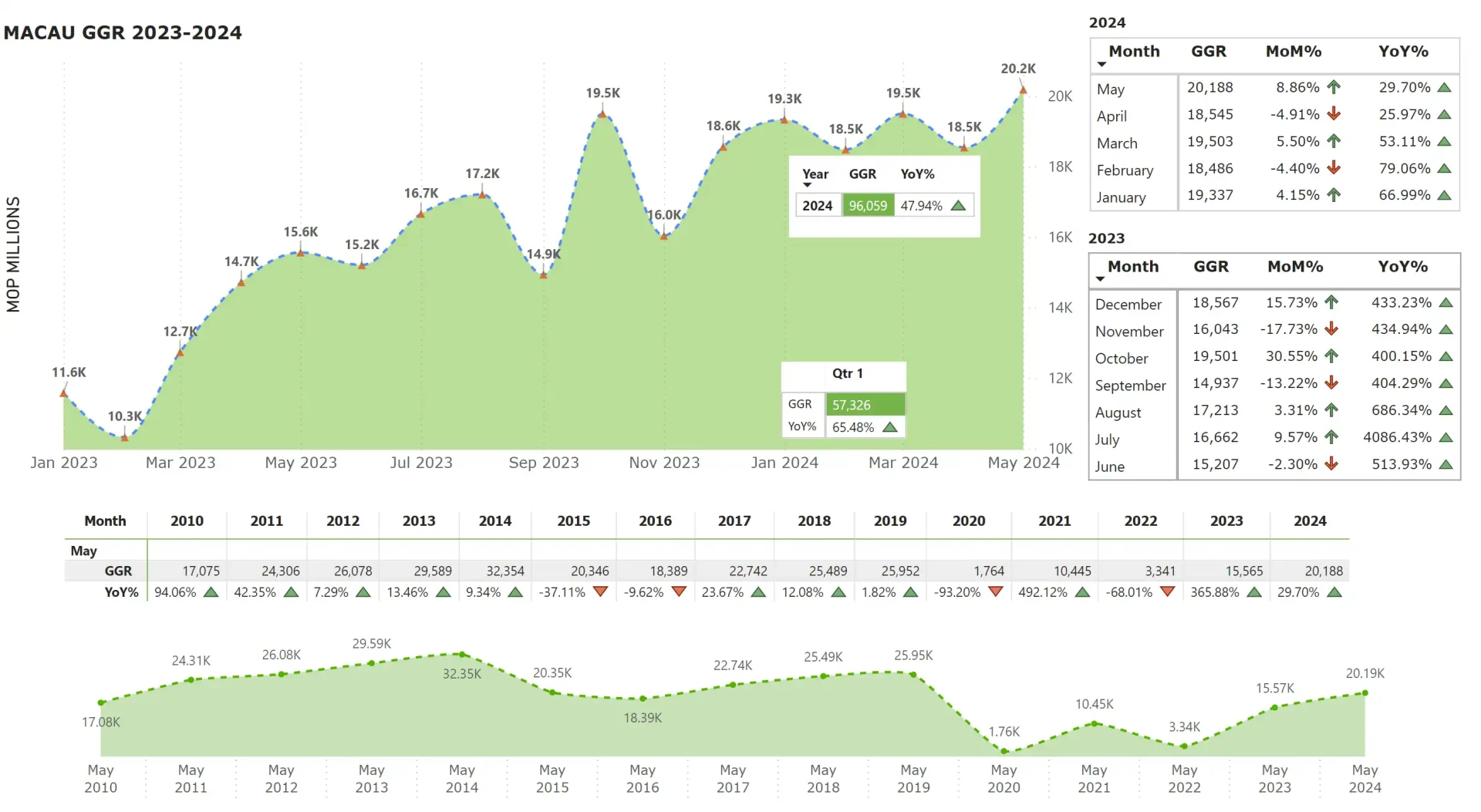

Macau GGR, May 2024

Macau gaming revenue being primarily driven by the mass market means that ‘non-gaming elements are increasingly important for gaming operators’.

Wang explains in the study that “VIP guests tend to focus more on gambling activities, while general tourists also engage in sightseeing, shopping, dining, and leisure, with gaming being just one part of their experience. Therefore, the convenience, comfort, novelty, and price attractiveness of accommodations, dining, and entertainment are key to attracting customers.”

Gaming companies aiming to attract gaming customers must focus more on non-gaming elements to drive gaming revenue. The study concludes that in the coming years, those companies that excel in non-gaming aspects will gain more gaming revenue, whereas those lacking in non-gaming attractions will face greater challenges in maintaining their gaming revenue.

Macau can expect ‘stable’ growth for next decade

Comparing Macau’s gaming sector with Singapore and the Philippines, which are seeing their gaming revenue already surpass pre-COVID levels despite their gaming industry scale much smaller than Macau’s, the scholar notes that Macau still has its ‘unique advantages’.

“MACAU IS CLOSE TO MAINLAND CHINA, PROVIDING A VAST TOURIST MARKET. IN THIS REGARD, MACAU’S ADVANTAGE IS UNPARALLELED.”

Wang Changbin

‘Macau’s gaming market has a clustering effect. In other countries, a region might have one or two casinos, whereas in Macau, there are dozens of casinos within a few square kilometers. Besides offering a wide variety of gaming activities, these casinos provide different entertainment, dining, and performance services, giving tourists a convenient and superior service experience.’

In addition, ‘Macau is politically, socially, and securely stable, ensuring that tourists do not worry about personal and property safety. These factors uniquely attract visitors.’

In this context, the study concludes that in the next decade, although Macau’s gaming industry may not grow as rapidly as before, as long as the mainland Chinese economy develops normally, Macau’s economy can still operate smoothly to a high degree. It is expected that Macau’s gaming industry will enter a period of stable development over the next ten years.

By Viviana Chan - June 27, 2024

agbrief.com/news/macau/27/06/2024/macau-gaming-struggles-to-return-to-pre-covid-heights-as-growth-factors-disappear-study/

A new paper on the post-pandemic reality of Macau’s gaming industry states that while the current situation is favorable, returning to pre-pandemic heights will be challenging. The main reason is that the factors that once drove Macau’s rapid growth are disappearing.

Wang Changbin,Director of the Center for Gaming and Tourism Studies, MPU

Published in the latest edition of Macau Polytechnic University’s (MPU) Global Gaming & Tourism Research, the study authored by Wang Changbin, director of the Center for Gaming and Tourism Studies, emphasizes that gaming in Macau has entered a new, less prominent era compared to the meteoric expansions of the 2000s and 2010s.

Wang Changbin indicates that the international situation is becoming increasingly complex, with frequent natural and man-made disasters hindering people’s willingness to travel. He also mentions that neighboring countries are continually opening casinos near China’s borders and taking various measures to attract Chinese residents.

Mainland China generally opposes its residents gambling abroad and has strengthened border control measures accordingly. Additionally, due to limited land resources, it is difficult for Macau to build new entertainment venues, reducing the allure of ‘new venues’ for tourists.

Wang also recalls that before the pandemic, a significant portion of Macau’s gaming revenue came from third-party VIP rooms. However, due to changes in China’s criminal law that severely crack down on junkets organizing Chinese citizens to gamble abroad, these junkets now face significant legal risks in bringing mainland VIP guests to Macau.

‘As a result, most gaming promoters have stopped promoting in the mainland, leading to a sharp decline in gaming revenue from third-party VIP rooms, dropping from 55 percent in 2018 to 24 percent in 2022. While junkets are actively seeking new clients from other regions, it will take time to see significant results.’

Additionally, as other Southeast Asian countries are also actively developing their gaming industries, there is fierce competition for clients from these regions. In the long term, it will be increasingly difficult for junkets to attract affluent individuals from outside Macau to participate in gaming activities.

Shift to mass market

The gaming scholar from the Center for Gaming and Tourism Studies notes that the composition of gaming revenue has significantly changed, with a substantial decrease in VIP revenue. In 2019, the total gross gaming revenue was MOP292.5 billion ($36.4 billion), with revenue from VIP segment accounting for MOP135.2 billion ($16.8 billion), or 46.2 percent.

In 2023, the total gross gaming revenue (GGR) was MOP183.1 billion ($22.8 billion), with VIP at MOP45.2 billion ($5.6 billion), dropping to 24.7 percent.

Macau GGR, December 2023

Gaming revenue has maintained at 60-80 percent of the 2019 level, with the majority coming from the mass market. ‘This situation is likely to become the new normal for Macau’s gaming industry in the coming years. Since these changes occurred at the legal level rather than due to short-term policies, they will have long-term effects, making substantial changes unlikely in the next few years.’

Macau GGR, May 2024

Macau gaming revenue being primarily driven by the mass market means that ‘non-gaming elements are increasingly important for gaming operators’.

Wang explains in the study that “VIP guests tend to focus more on gambling activities, while general tourists also engage in sightseeing, shopping, dining, and leisure, with gaming being just one part of their experience. Therefore, the convenience, comfort, novelty, and price attractiveness of accommodations, dining, and entertainment are key to attracting customers.”

Gaming companies aiming to attract gaming customers must focus more on non-gaming elements to drive gaming revenue. The study concludes that in the coming years, those companies that excel in non-gaming aspects will gain more gaming revenue, whereas those lacking in non-gaming attractions will face greater challenges in maintaining their gaming revenue.

Macau can expect ‘stable’ growth for next decade

Comparing Macau’s gaming sector with Singapore and the Philippines, which are seeing their gaming revenue already surpass pre-COVID levels despite their gaming industry scale much smaller than Macau’s, the scholar notes that Macau still has its ‘unique advantages’.

“MACAU IS CLOSE TO MAINLAND CHINA, PROVIDING A VAST TOURIST MARKET. IN THIS REGARD, MACAU’S ADVANTAGE IS UNPARALLELED.”

Wang Changbin

‘Macau’s gaming market has a clustering effect. In other countries, a region might have one or two casinos, whereas in Macau, there are dozens of casinos within a few square kilometers. Besides offering a wide variety of gaming activities, these casinos provide different entertainment, dining, and performance services, giving tourists a convenient and superior service experience.’

In addition, ‘Macau is politically, socially, and securely stable, ensuring that tourists do not worry about personal and property safety. These factors uniquely attract visitors.’

In this context, the study concludes that in the next decade, although Macau’s gaming industry may not grow as rapidly as before, as long as the mainland Chinese economy develops normally, Macau’s economy can still operate smoothly to a high degree. It is expected that Macau’s gaming industry will enter a period of stable development over the next ten years.