Post by Blitz on Jun 12, 2024 7:30:12 GMT -5

Macau 2024 GGR forecast hits $30B amid higher visitation assumptions: CLSA

Viviana Chan - June 11, 2024

agbrief.com/news/macau/11/06/2024/macau-2024-ggr-forecast-hits-30b-amid-higher-visitation-assumptions-clsa/

Due to higher visitation and GGR/visitor assumptions, brokerage firm CLSA has revised its forecast for Macau’s 2024 gross gaming revenue (GGR) upward by 1.6 percent, projecting it to reach MOP$239.9 billion ($29.8 billion) this year.

This latest adjustment also increases the 2025 GGR forecast by 3.2 percent, taking into account higher gambling budgets and increased visitations, driven by the recently announced expansion of eligible cities under the Individual Visitation Scheme (IVS).

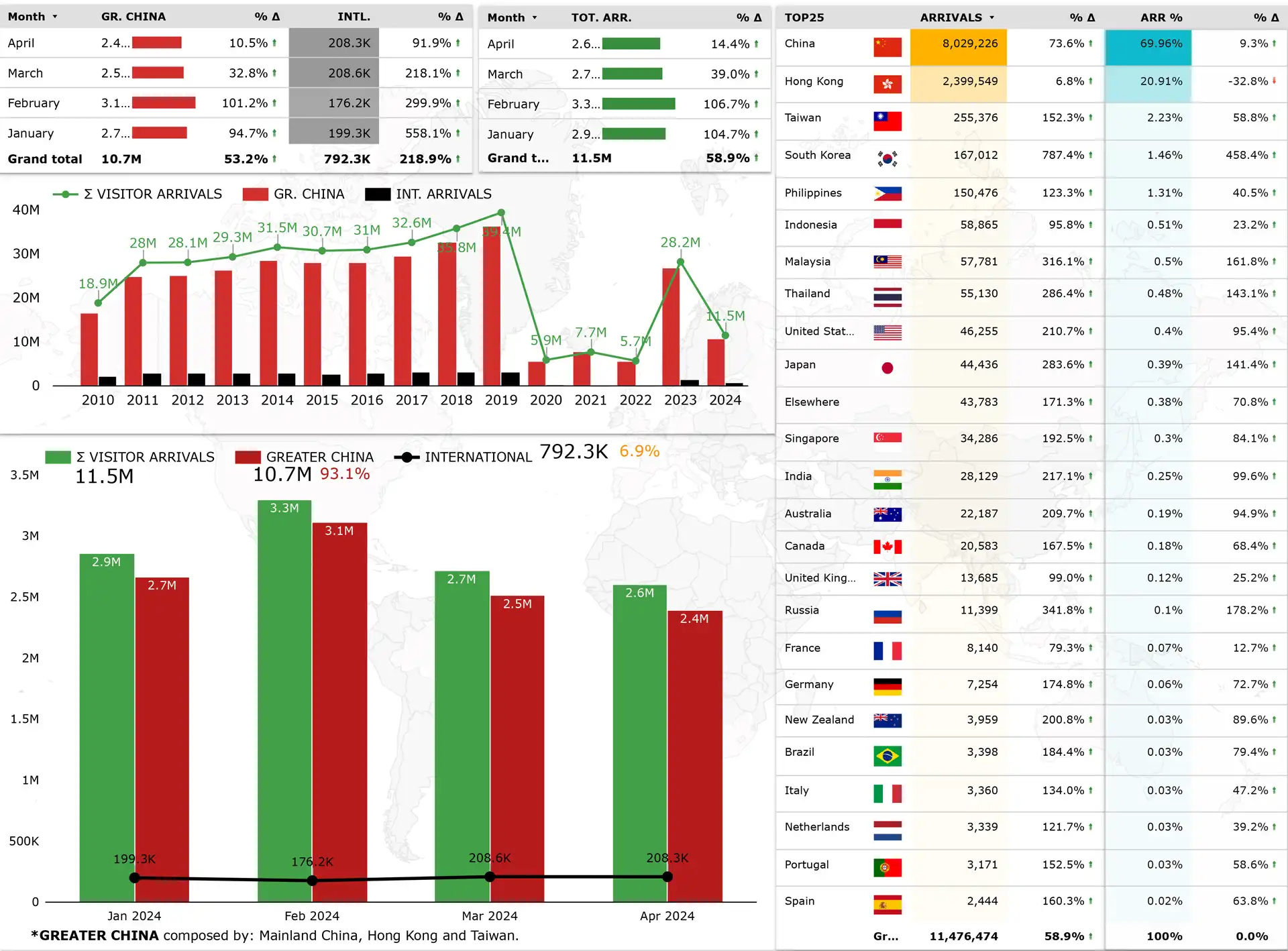

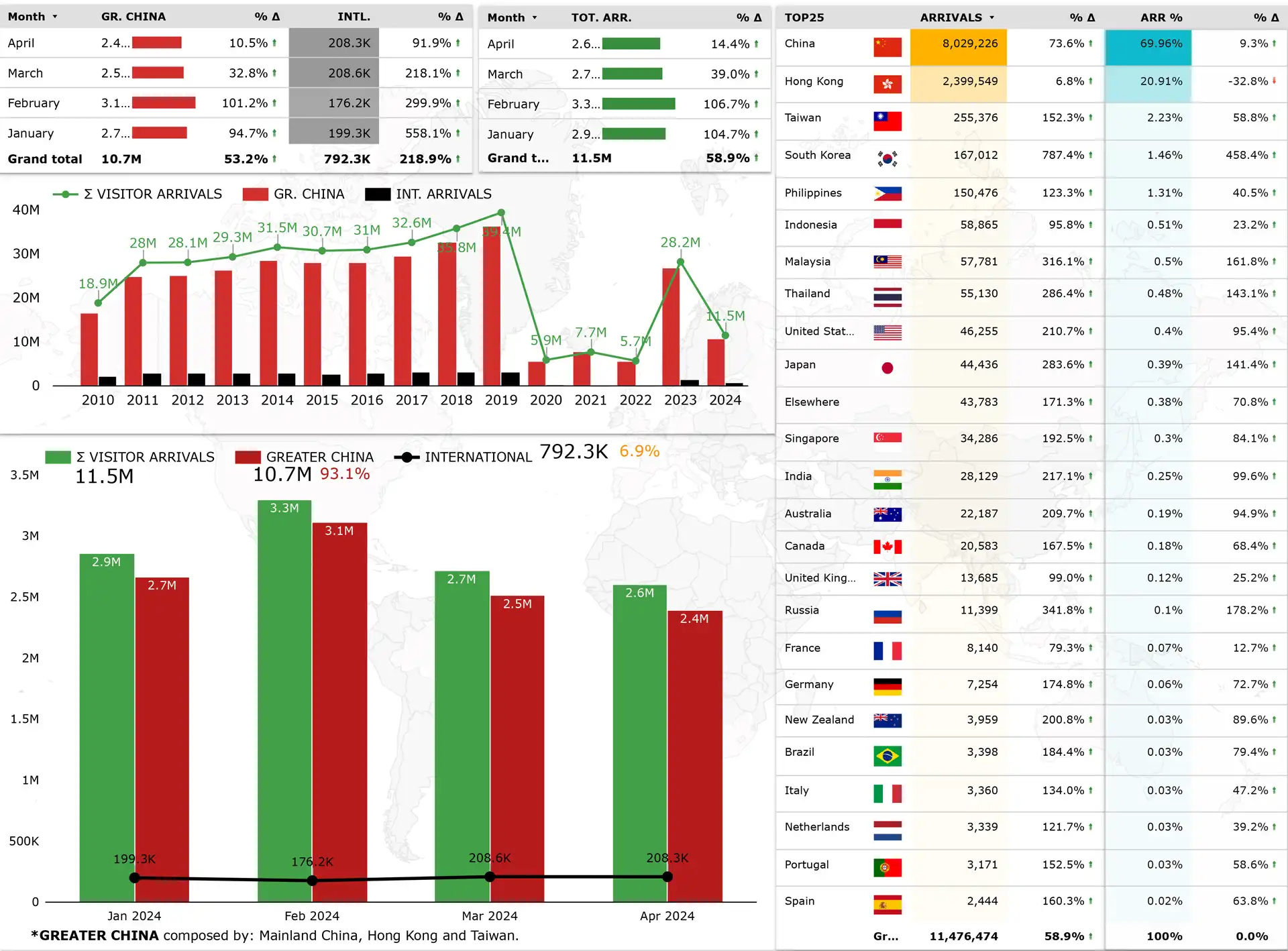

Macau Visitor Arrivals 2024

Analysts at CLSA note that these projections indicate Macau’s GGR will experience a year-on-year growth of 31.1 percent, reaching MOP$239.9 billion ($29.8 billion) in 2024, followed by a 6.4 percent increase to MOP$255.2 billion ($31.7 billion) in 2025.

Simultaneously, the gaming sector’s EBITDA expectation is also raised, projected to reach $9.7 billion in 2025, approximately 2 percent higher than 2019 levels.

Macau, Cotai Strip

GGR growth led by grind and base mass segments

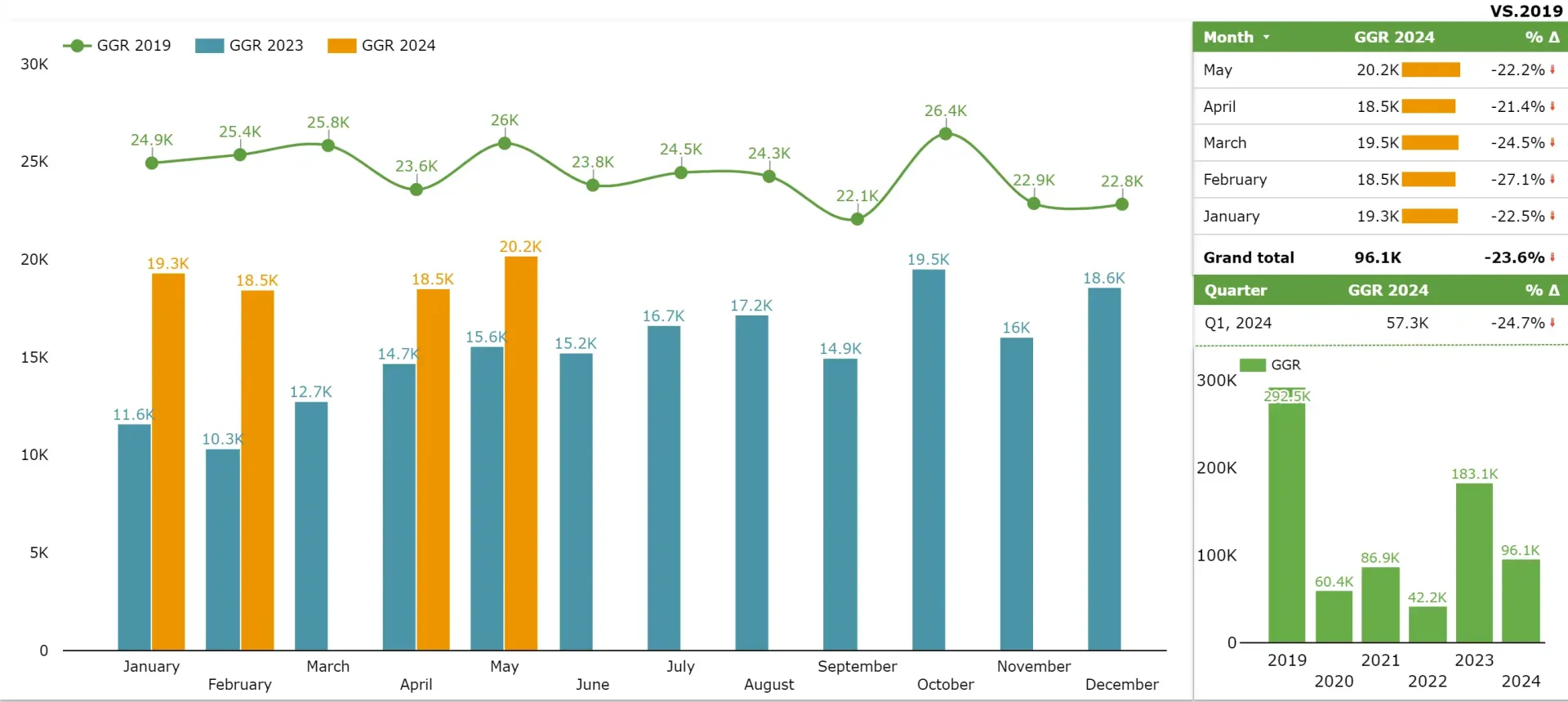

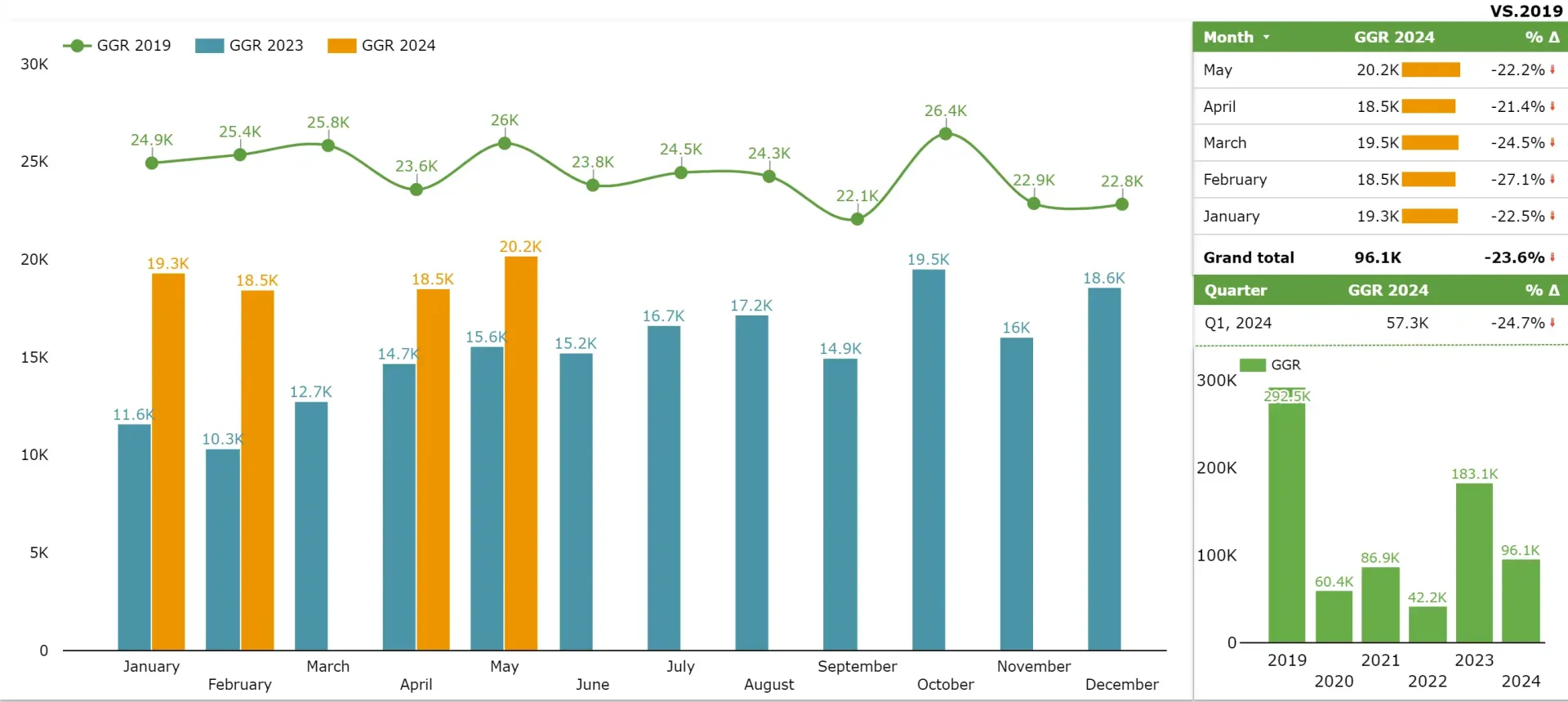

In an investment memo, CLSA notes that intact gaming demand plus policy support have contributed to visitation. Macau’s GGR in May achieved a new post-COVID high, reaffirming that demand for gaming in Macau remains intact, although the overall level is still 22 percent below May 2019 levels.

Macau May GGR 2024

The previous check conducted by the same brokerage also confirms that ‘Macau remains the most alluring gaming destination for Chinese due to its close proximity to China in every aspect. Premium players are still showing up in Macau.’

In this context, analysts Jeffrey Kiang and Leo Pan conclude that incremental GGR growth will likely be led by the grind and base mass segments. As general policies ease, especially following the expansion of IVS eligible cities, an additional aggregate population size of 45 million is expected to be captured.

‘This is 14 percent above the visitations in Macau in 2019, which totaled 39.4 million. Ongoing strong demand in the premium segment and policy support for visitations bode well for Macau’s GGR,’ it adds in the memo.

Macau, Tourism, Golden Week, daily visitors

Competition remains intense

Despite the positive momentum in terms of visitation and GGR growth, the brokerage warns that competition among concessionaires remains intense.

Aggregate rebates and reinvestment in players increased by 10 percent quarter-on-quarter in 1Q24 to $1.27 billion, faster than the corresponding GGR growth of 6 percent from 4Q23 to 1Q24. As a result, rebates represented 18 percent of the sector’s GGR in 1Q24, up from 17.3 percent in 4Q23. In this context, analysts expect ‘intense rivalry ahead as such investments are essential to drive business.’

Andaz Macau, Galaxy Entertainment, Macau

Galaxy expected to gain share

In an analysis of the Macau gaming concessionaires, CLSA forecasts that Galaxy is likely to gain market share. Its share is expected to expand from 17.4 percent in 1Q24 to 18.2 percent in 4Q24 and further to roughly 18.9 percent in 4Q26.

By contrast, MGM China is expected to lose market share, declining from 17.2 percent in 1Q24 to 15.1 percent in 4Q24 and remaining largely steady through 4Q26.

Viviana Chan - June 11, 2024

agbrief.com/news/macau/11/06/2024/macau-2024-ggr-forecast-hits-30b-amid-higher-visitation-assumptions-clsa/

Due to higher visitation and GGR/visitor assumptions, brokerage firm CLSA has revised its forecast for Macau’s 2024 gross gaming revenue (GGR) upward by 1.6 percent, projecting it to reach MOP$239.9 billion ($29.8 billion) this year.

This latest adjustment also increases the 2025 GGR forecast by 3.2 percent, taking into account higher gambling budgets and increased visitations, driven by the recently announced expansion of eligible cities under the Individual Visitation Scheme (IVS).

Macau Visitor Arrivals 2024

Analysts at CLSA note that these projections indicate Macau’s GGR will experience a year-on-year growth of 31.1 percent, reaching MOP$239.9 billion ($29.8 billion) in 2024, followed by a 6.4 percent increase to MOP$255.2 billion ($31.7 billion) in 2025.

Simultaneously, the gaming sector’s EBITDA expectation is also raised, projected to reach $9.7 billion in 2025, approximately 2 percent higher than 2019 levels.

Macau, Cotai Strip

GGR growth led by grind and base mass segments

In an investment memo, CLSA notes that intact gaming demand plus policy support have contributed to visitation. Macau’s GGR in May achieved a new post-COVID high, reaffirming that demand for gaming in Macau remains intact, although the overall level is still 22 percent below May 2019 levels.

Macau May GGR 2024

The previous check conducted by the same brokerage also confirms that ‘Macau remains the most alluring gaming destination for Chinese due to its close proximity to China in every aspect. Premium players are still showing up in Macau.’

In this context, analysts Jeffrey Kiang and Leo Pan conclude that incremental GGR growth will likely be led by the grind and base mass segments. As general policies ease, especially following the expansion of IVS eligible cities, an additional aggregate population size of 45 million is expected to be captured.

‘This is 14 percent above the visitations in Macau in 2019, which totaled 39.4 million. Ongoing strong demand in the premium segment and policy support for visitations bode well for Macau’s GGR,’ it adds in the memo.

Macau, Tourism, Golden Week, daily visitors

Competition remains intense

Despite the positive momentum in terms of visitation and GGR growth, the brokerage warns that competition among concessionaires remains intense.

Aggregate rebates and reinvestment in players increased by 10 percent quarter-on-quarter in 1Q24 to $1.27 billion, faster than the corresponding GGR growth of 6 percent from 4Q23 to 1Q24. As a result, rebates represented 18 percent of the sector’s GGR in 1Q24, up from 17.3 percent in 4Q23. In this context, analysts expect ‘intense rivalry ahead as such investments are essential to drive business.’

Andaz Macau, Galaxy Entertainment, Macau

Galaxy expected to gain share

In an analysis of the Macau gaming concessionaires, CLSA forecasts that Galaxy is likely to gain market share. Its share is expected to expand from 17.4 percent in 1Q24 to 18.2 percent in 4Q24 and further to roughly 18.9 percent in 4Q26.

By contrast, MGM China is expected to lose market share, declining from 17.2 percent in 1Q24 to 15.1 percent in 4Q24 and remaining largely steady through 4Q26.