Post by Blitz on Jan 10, 2024 6:15:39 GMT -5

Macau’s economy is expected to grow 10 percent in 2024 as gaming activities normalize, says S&P

AGBrief Editorial - January 9, 2024

agbrief.com/news/macau/09/01/2024/macaus-economy-to-grow-10-percent-in-2024-as-gaming-activities-normalized-says-sp/

S&P Global Ratings expects that Macau’s real GDP will rebound strongly by about 78 percent in 2023 and forecasts growth of another 10 percent in 2024 after a 21 percent contraction in 2022.

The projection was based on the facts of a surge in visitors and normalization of gaming activities following the lifting of travel restrictions related to the pandemic, which should continue to underpin Macau’s economic recovery.

According to the investment memo related to the Banking Industry Country Risk Assessment (BICRA), the rating agency notes that Macau’s economy heavily relies on gaming and tourism, which constrains its economic resilience.

‘Concentration of business in these sectors exposes the economy to high swings, as reflected in Macau’s performance throughout the pandemic.’

‘The income inequality is high. We expect the government will continue to focus on diversifying its economy toward non-gaming sectors, but this will likely take time.’

The high concentration in the gaming industry also led to pressure on the banking industry. S&P Global Ratings points out that ‘Macau’s high proportion of cyclical industries such as gaming and tourism, and the volatility of property prices, expose banks to the risk of a rapid rise in credit losses during an economic downturn.’

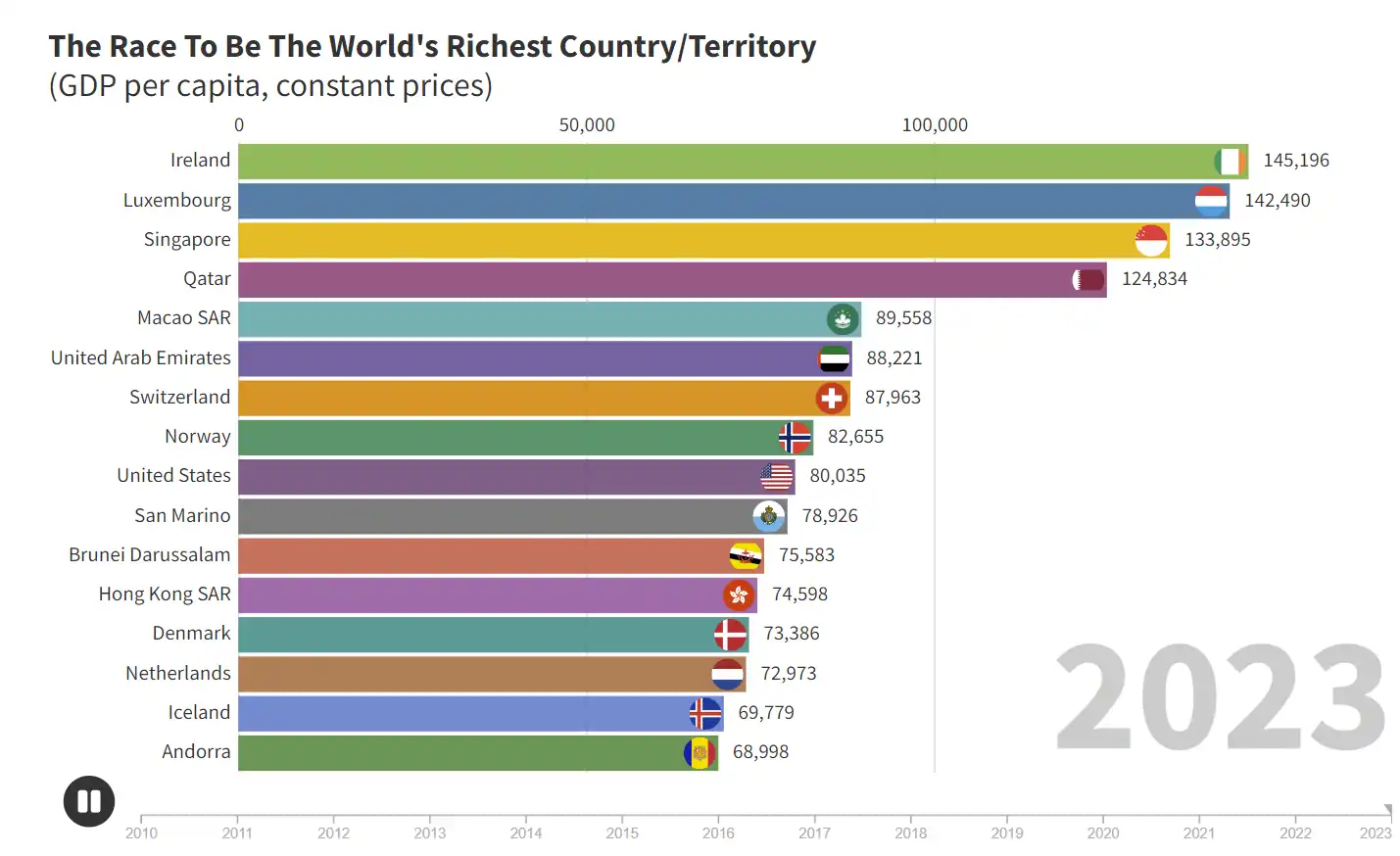

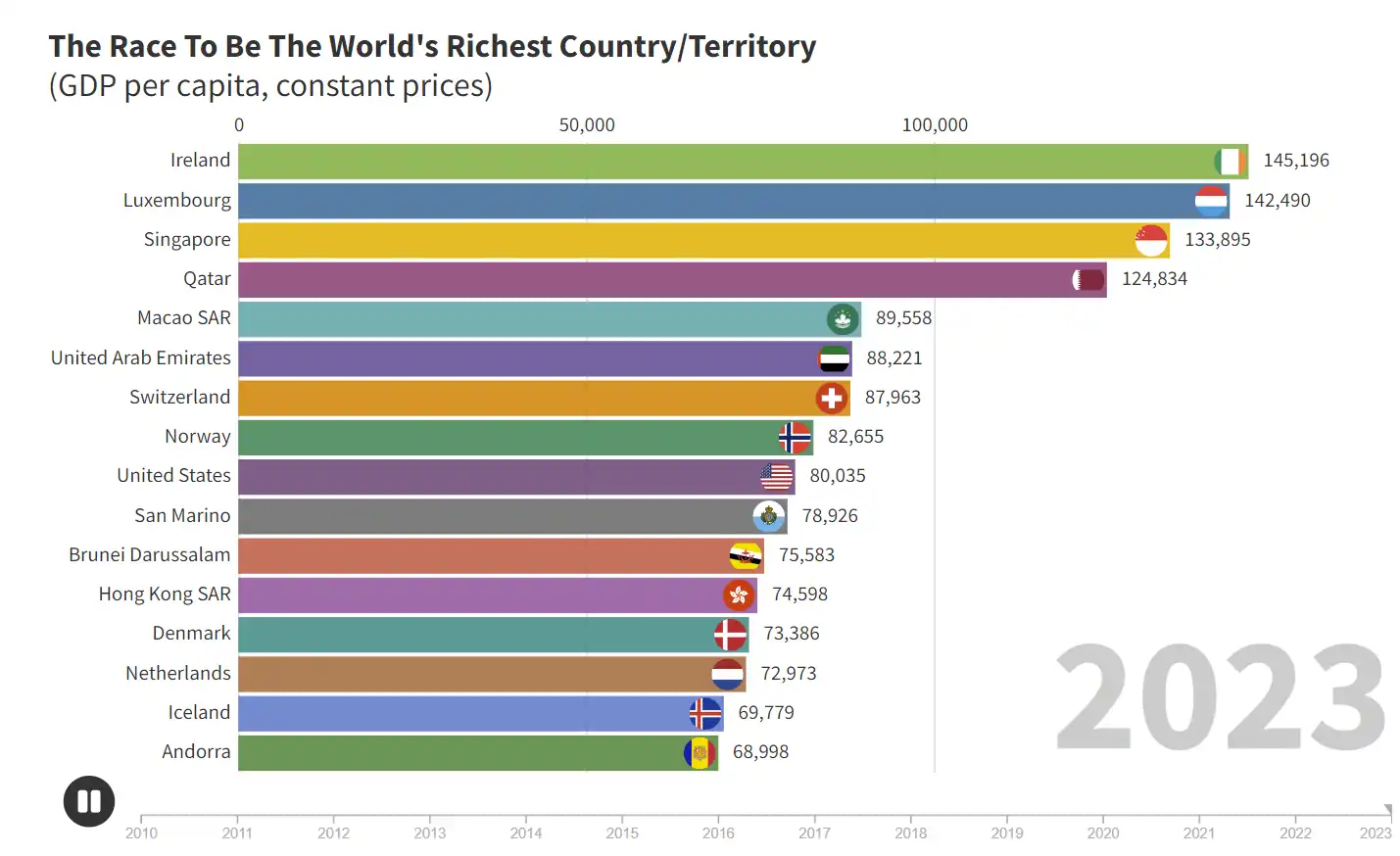

Macau is one of the richest regions in the world in terms of per capita GDP. Nevertheless, the research team considers the high per capita GDP (about $63,500 in 2023) ‘overstates’ the strength of the economy.

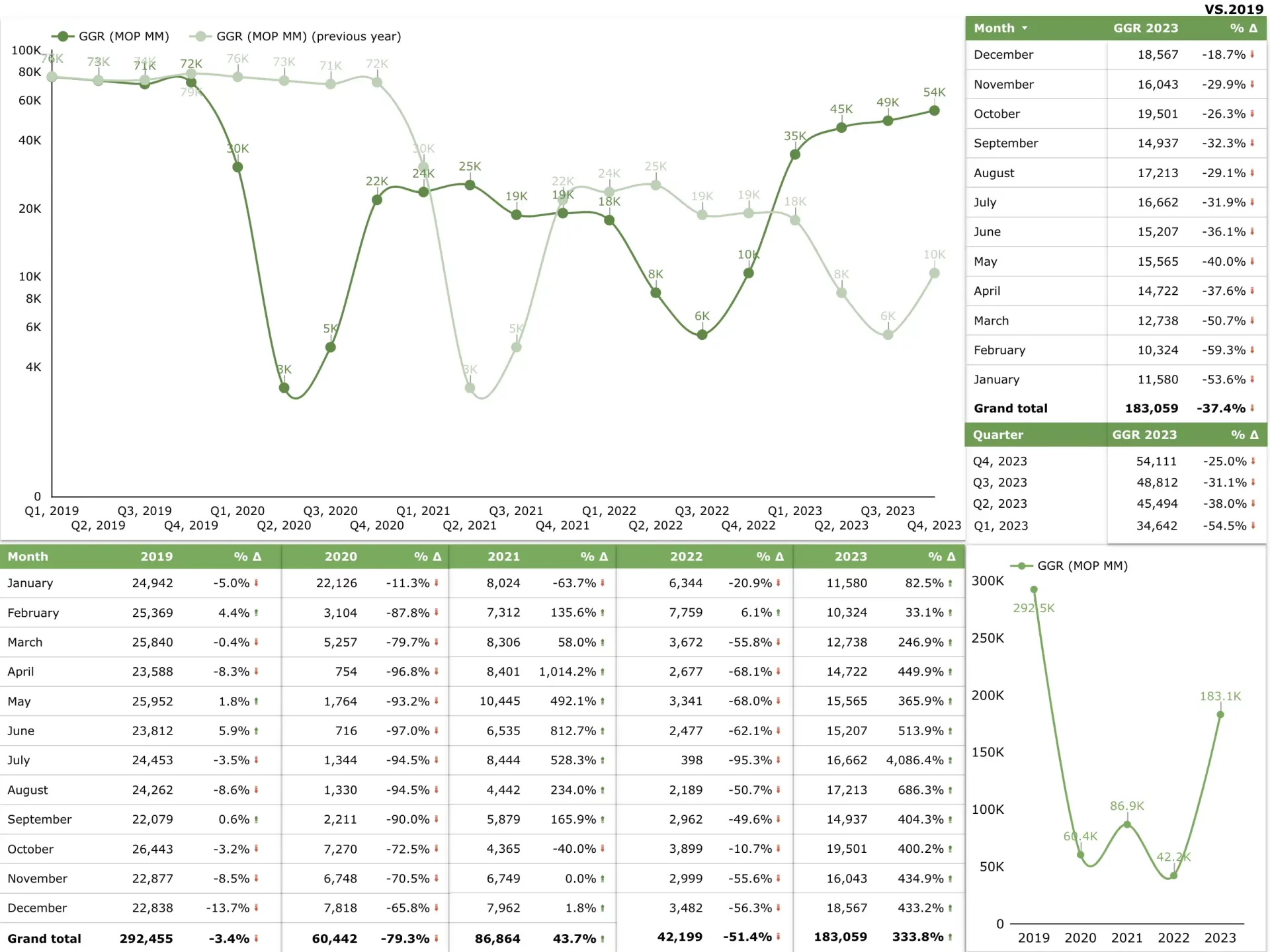

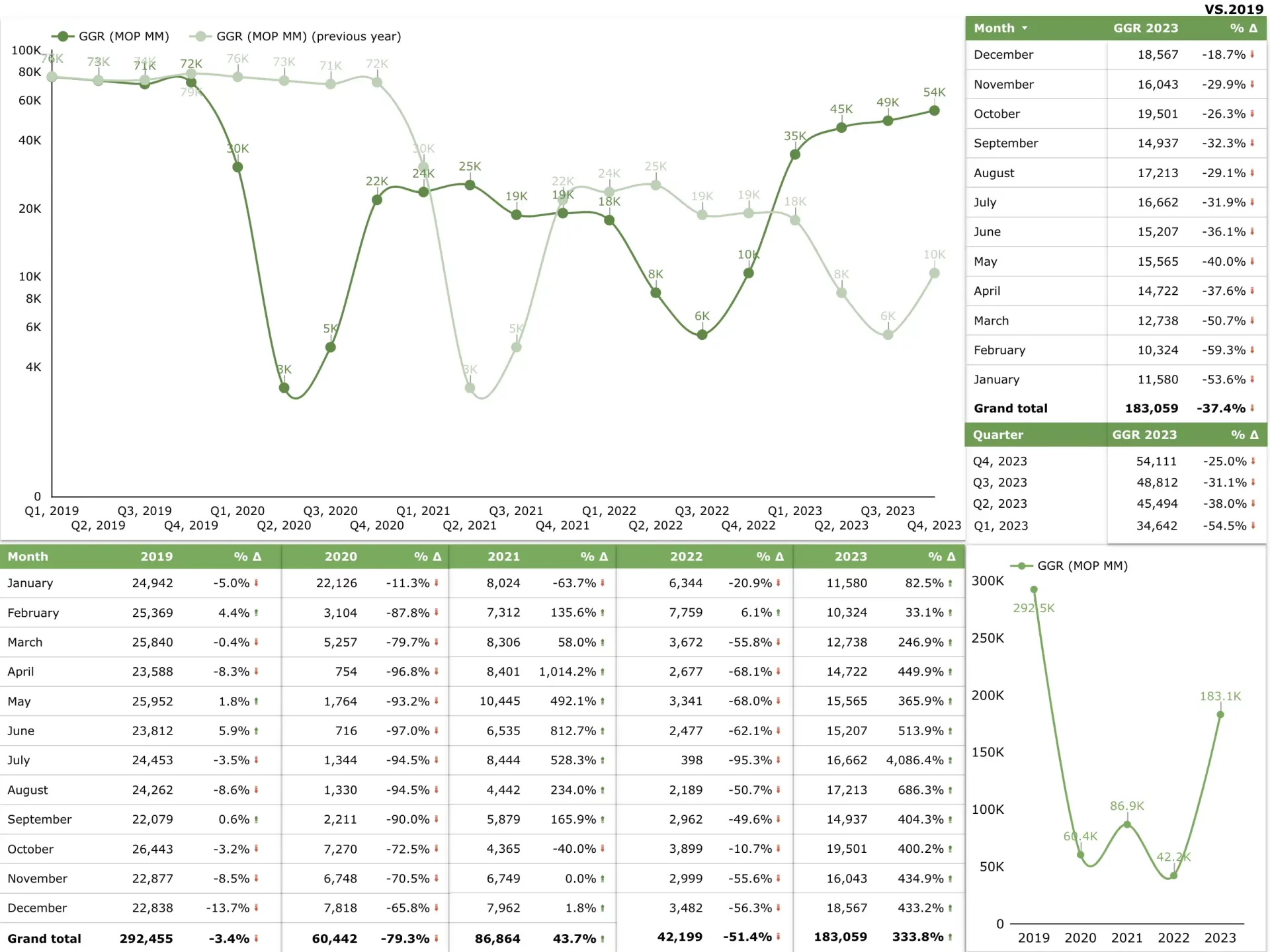

Macau’s GDP has a high correlation with the gross gaming revenue (GGR). Macau’s GGR amounted to MOP183.1 billion ($22.68 billion) in 2023, indicating a 333.8 percent surge compared to 2022. Based on investment banks’ projection, Macau’s GGR in 2024 could increase 15 to 28 percent yearly.

At the same note, S&P indicates that Macau’s currency board regime is considered to limit monetary flexibility. ‘The Macanese pataca (MOP) is pegged to the Hong Kong dollar at 1 HK$: 1.03 MOP. Macau under China’s “One Country, Two Systems” framework does not present material political risk.’

Hong Kong dollar, despite is not the local currency, is the currency used for gambling in Macau.

S&P believes the Macau government is committed to adequately managing money laundering risks related to the gaming sector. ‘The structure of the Macau banking sector will likely be stable over the next two years.’

AGBrief Editorial - January 9, 2024

agbrief.com/news/macau/09/01/2024/macaus-economy-to-grow-10-percent-in-2024-as-gaming-activities-normalized-says-sp/

S&P Global Ratings expects that Macau’s real GDP will rebound strongly by about 78 percent in 2023 and forecasts growth of another 10 percent in 2024 after a 21 percent contraction in 2022.

The projection was based on the facts of a surge in visitors and normalization of gaming activities following the lifting of travel restrictions related to the pandemic, which should continue to underpin Macau’s economic recovery.

According to the investment memo related to the Banking Industry Country Risk Assessment (BICRA), the rating agency notes that Macau’s economy heavily relies on gaming and tourism, which constrains its economic resilience.

‘Concentration of business in these sectors exposes the economy to high swings, as reflected in Macau’s performance throughout the pandemic.’

‘The income inequality is high. We expect the government will continue to focus on diversifying its economy toward non-gaming sectors, but this will likely take time.’

The high concentration in the gaming industry also led to pressure on the banking industry. S&P Global Ratings points out that ‘Macau’s high proportion of cyclical industries such as gaming and tourism, and the volatility of property prices, expose banks to the risk of a rapid rise in credit losses during an economic downturn.’

Macau is one of the richest regions in the world in terms of per capita GDP. Nevertheless, the research team considers the high per capita GDP (about $63,500 in 2023) ‘overstates’ the strength of the economy.

Macau’s GDP has a high correlation with the gross gaming revenue (GGR). Macau’s GGR amounted to MOP183.1 billion ($22.68 billion) in 2023, indicating a 333.8 percent surge compared to 2022. Based on investment banks’ projection, Macau’s GGR in 2024 could increase 15 to 28 percent yearly.

At the same note, S&P indicates that Macau’s currency board regime is considered to limit monetary flexibility. ‘The Macanese pataca (MOP) is pegged to the Hong Kong dollar at 1 HK$: 1.03 MOP. Macau under China’s “One Country, Two Systems” framework does not present material political risk.’

Hong Kong dollar, despite is not the local currency, is the currency used for gambling in Macau.

S&P believes the Macau government is committed to adequately managing money laundering risks related to the gaming sector. ‘The structure of the Macau banking sector will likely be stable over the next two years.’