|

|

Post by Blitz on Jan 3, 2024 8:26:53 GMT -5

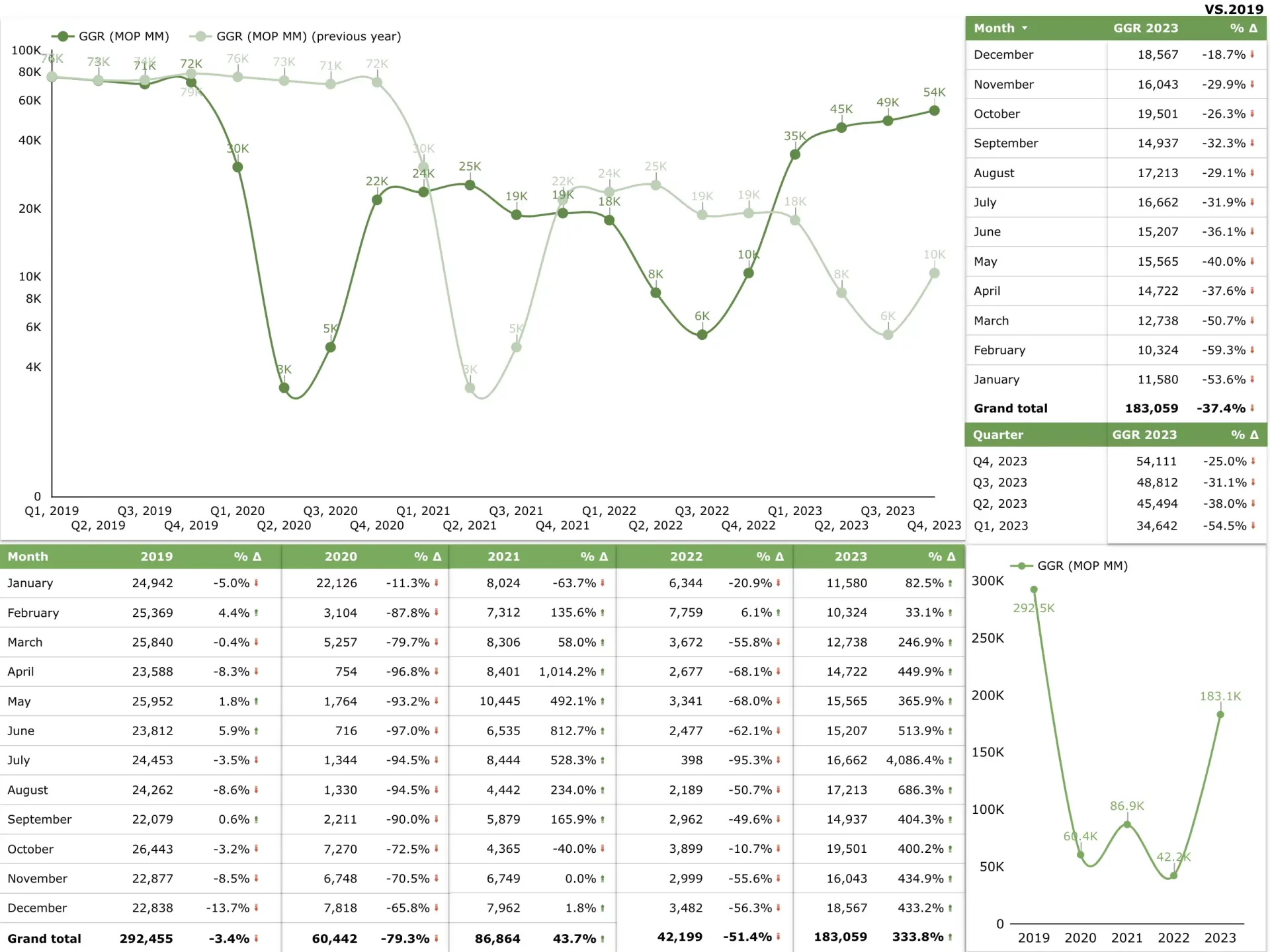

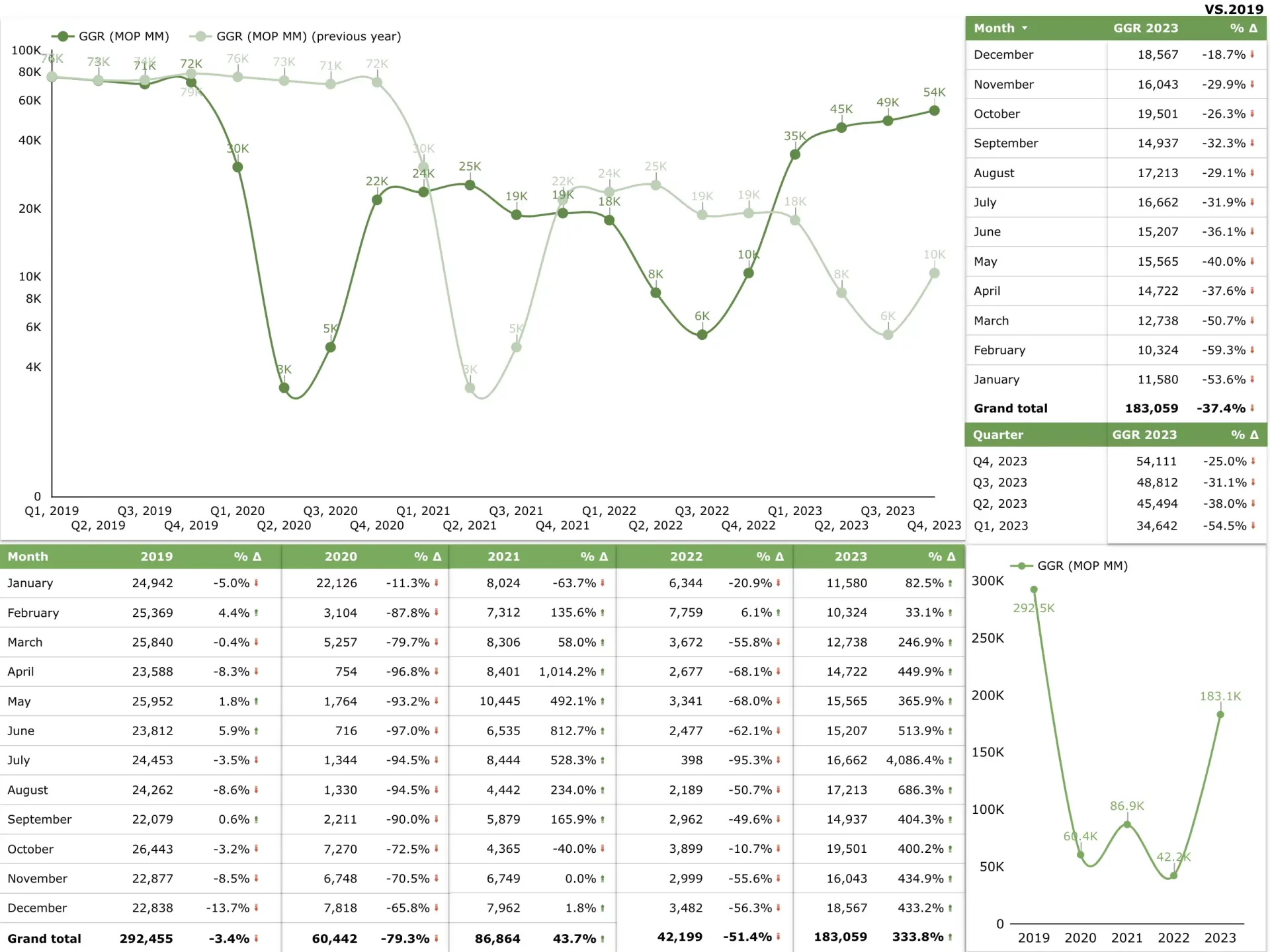

Morgan Stanley: Macau GGR to grow by 28% in 2024 but concessionaire opex and capex requirements likely to increase by Ben Blaschke Wed 3 Jan 2024 at 05:56 www.asgam.com/index.php/2024/01/03/morgan-stanley-macau-ggr-to-grow-by-28-in-2024-but-concessionaire-opex-and-capex-requirements-likely-to-increase/Macau’s gross gaming revenue is on track to grow by 28% year-on-year in 2024, reaching 80% of pre-COVID levels according to investment bank Morgan Stanley. In a note following release of Macau’s December 2023 and FY23 revenue results – with GGR exceeding expectations at MOP$183.1 billion (US$22.7 billion) – Morgan Stanley analysts Praveen Choudhary and Gareth Leung said Macau’s strong finish to 2023 bodes well for the year ahead, with GGR tipped to grow from 62% of 2019 levels to around 80%. December’s GGR figure of MOP$18.57 billion (US$2.30 billion) also accelerated faster than traditional seasonality, which “should bode well for a 2024 recovery. “If we assume VIP recovery in Dec was 30% of 2019’s level (23% in 3Q23), mass recovery should be ~20% above 2019,” the analysts wrote. January, they added, would likely see GGR remain flat month-on-month at MOP$18.8 billion, representing 75% of pre-COVID levels. In a previous note published in December, Choudhary and Leung said they expect both opex and capex of Macau’s concessionaires to increase in 2024, driven by wage hikes and mandatory non-gaming investment commitments. “We expect Macau gaming companies to follow the Macau government and increase wages by 2% to 3% in 2024,” they wrote, adding that the traditional “13th month” salary bonus would remain in place. “We also think the opex portion of non-gaming investment, and potential competitions for gaming hosts/sales, could put upward pressure to opex. “On capex, we think companies will accelerate their non-gaming spend in 2024. Sands has the scale to have 76% of its committed investment in capex while other operators will need to spend more on opex, which could impact their margin.” |

|

|

|

Post by Blitz on Jan 5, 2024 7:33:59 GMT -5

LOCAL EXPERT FORECASTS 2024 GGR TO GROW 15% FROM 2023 RENATO MARQUES, MDT FRIDAY, JANUARY 5, 2024 - 12 HOURS AGO macaudailytimes.com.mo/local-expert-forecasts-2024-ggr-to-grow-15-from-2023.htmlLocal gaming industry expert and analyst Ben Lee has projected that local casinos’ gross gaming revenue (GGR) in 2024 should increase by some 15% when compared year-on-year with 2023. The managing partner at IGamiX forecasts that the industry should reach the end of this year with an accumulated GGR of MOP210.52 billion, as 2023 closed with a total of MOP 183.06 billion. This is also the most conservative forecast for 2024 so far, presenting a result even below the local government expectations of MOP216 billion. Prior to Lee’s forecast, the most conservative projection was from another local analyst, Davis Fong, who said that the industry should generate as much as MOP220 billion in 2024. The gaming sector scholar at the University of Macau and director of the Institute for the Study of Commercial Gaming presented this projection in November last year. International brokerage companies seem more optimistic with Morgan Stanley recently forecasting a 28% increase for this year (MOP234.32 billion). Less than a month ago, Fitch Ratings provided a forecast of Macau’s gaming industry in 2024 as some MOP231 billion in revenue. Traditionally, forecasts from the local government have been the most conservative, including in 2023 when the government estimated the GGR to be around MOP130 billion, a figure far from the actual one of over MOP183B. Lee has previously explained to the Times that it is very difficult to make an accurate and reliable projection for the local market one year ahead. This is because the local market is “special” in that it is subject to several decisive external factors, other than the will of the players, that are not easy to predict. Among such factors are aspects such as the issuing of individual visas to mainland visitors (the large majority of Macau gamblers) as well as other aspects related to potential constraints to be imposed on “visitors influx” that can come at any time and that are not “market regulated.” |

|

|

|

Post by Blitz on Jan 9, 2024 14:43:57 GMT -5

Macau Gaming Industry Estimated to Reach US$29.2 Billion in 2024 Radosav Milutinovic - January 9, 2024 news.worldcasinodirectory.com/macau-gaming-industry-estimated-to-reach-us29-2-billion-in-2024-111746Jeffrey Kiang, an analyst at capital markets and investments group CLSA Ltd, estimates that the Macau gaming industry could generate US$29.2 billion in gross gaming revenues in 2024. As GGRAsia reports, such a handle would represent almost 30 percent growth in comparison to the level reached by Macau gaming operators in 2023. 2019 Benchmark Figure: As reported, Kiang’s 2024 gross gaming revenue estimate would also stand for about 82 percent of the 2019 benchmark figures. In fact, Macau’s gaming market reached its peak in 2019 to decline over the subsequent years due to pandemic-driven gaming facility closures. The market re-opened on 8 January 2023 to rapidly grow during the year. But the stakeholders and analysts might consider the market fully recovered once it has reached the 2019 levels. According to the source, CLSA anticipates that Macau’s casino industry will continue to fall behind the benchmark levels to see a modest increase in 2025 as well. US$29.2 Billion Handle Expected in 2024: In 2019, the city’s operators generated around US$35.6 billion in gross gaming revenues. The institution reportedly expects that the industry could reach 82 percent of the 2019 tally in 2024, or US$29.2 billion, to be followed by the 89 percent stake in 2025. Kiang told the source: “By segment, we forecast 2024’s overall mass GGR (including premium mass, but excluding slot machines) to increase 31 percent year-on-year to US$23.2 billion (or HKD181.2 billion, being 18 percent above 2019’s level).” At the same time, the estimated 2024 handle of US$29.2 billion would reportedly represent a 28.4 percent growth from the US$22.75 billion handled by the industry in 2023. According to GGRAsia, the most significant contribution to the 2024 annual growth may be seen in the first half of the year likely to be featured by increased visits from mainland China. Kiang reportedly expects that this major driver of the Macau’s gaming and hospitality sector will continue the recovery towards pre-pandemic levels. The analyst reportedly said: “Mathematically, the first half of 2023 was still a low base for Macau’s GGR, as it took time for Macau to solve the labor shortage bottleneck and [for] transportation capacity from [mainland] China to ramp… We expect holiday GGR performance [in 2024] to be robust – but that would be quite even” in terms of split, between “the first half (Chinese New Year and May Golden Week) and the second half (summer holiday and October Golden Week)”. Market Leaders: As GGRAsia reports, the precise 2023 calendar year gross gaming revenue figures are still expected. For reference purposes, the current 2023 reports stand at US$22.75 billion to represents a 64 percent share of the 2019 GGR level. As a sequence of the total, Macau casino operators Sands China Ltd, Galaxy Entertainment Group Ltd and MGM China Holdings Ltd are reportedly expected to have taken the largest market share in 2023 with gross revenue figures estimated by CLSA at about US$6.1 billion, US$4.14 billion, and US$3.31 billion, respectively. CLSA reportedly expects Sands China and Galaxy Entertainment to maintain the largest market share in 2024. With the 2024 gross gaming revenue forecast set at US$29.2 billion, CLSA reportedly estimates that the Macau gaming sector’s EBITDA will reach US$8.5 billion to represent 92 percent of the 2019 level. |

|

|

|

Post by bjspokanimal on Jan 14, 2024 18:02:13 GMT -5

Some thoughts about 2024 GGR being 82% of 2019's and 2025 coming in at

89% of 2019...

This year's GGR is going to be much more comprised of mass and premium

mass gaming as China's general crackdown on the mechanics of VIP has

significantly altered the mix. This is relevant because the margins on

both mass categories are much higher than they are for VIP.

The gaming concessionaires liked VIP because VIP gaming made up for in

volume (drop) what it lacked in margin per unit bet (hold). But, if

future GGR eventually equals 2019 GGR, but with a much higher proportion

of mass vs VIP, that spells profit growth for Macau's GGR. It also probably spells growth

in non-gaming spend since mass bettors are more interested in shopping,

shows, etc. than VIP bettors have traditionally been.

Finally, higher proportions of mass gamblers also plays into LVS's strengths

since LVS was the first of the concessionaires to truly embrace mass over

VIP almost a decade ago, and has structured a much greater portion of it's

offerings toward mass, not to mention MICE. Sands has also emphasized non-

gaming more than the other concessionaires, which should benefit from an

increasingly higher proportion of mass bettors.

The dark days of covid look increasingly behind us nowadays and LVS appears

as focused on mass and premium mass vs it's competition as Transocean is

focused on ultra-deepwater and HE semis much more than IT'S competition. In

that regard, it's how these companies specialize that's one of my key

attractions to them as an investor... not so much LVS as back in the growth

heydays, but I like the cyclical recovery we're seeing enough to still hang

onto a significant amount of LVS stock as the recovery hopefully grows and

matures.

|

|

|

|

Post by Blitz on Jan 15, 2024 6:15:20 GMT -5

SLASH IN JUNKETS A ‘NORMAL MARKET ADJUSTMENT’ LYNZY VALLES, MDT MONDAY, JANUARY 15, 2024 - 11 HOURS AGO macaudailytimes.com.mo/slash-in-junkets-a-normal-market-adjustment.htmlThe slash in the number of Macau’s junkets is in line with the city’s development on economic transformation. Macau has again seen a reduction of licensed junkets this year after figures from the government show the number of gaming promoters has been slashed to 18. The figure represents 50% of 2023’s numbers, according to information from the Gaming Inspection and Coordination Bureau (DICJ). The latest reduction comes after the government enforced the largest gaming law overhaul in Macau’s history, as well as the junkets law, which states that junkets can no longer engage in revenue sharing arrangements with concessionaires. Gaming scholar Davis Fong said the decrease in gaming junket licensees is a normal market adjustment. He said it is expected the relevant numbers will not change much, adding the positioning of the gaming industry towards the mass market is in line with Macau’s positioning as a world tourism and leisure center and is suitable for the mid- to long-term development of Macau’s gaming. Kwok Chi Chung, a board member of the General Association of Administrators and Promoters for the Macau Gaming Industry, echoed similar sentiments, noting the reduction of junkets is “reasonable and normal.” He said the main reason for the decrease of gaming junket licenses is still the changes in customer sources, markets and business models, as cited in a TDM report. Currently, independent travelers are the main source, and the gaming industry is moving towards a mass consumption model. He believes the market-dominated trend will not change. The Secretary for Economy and Finance has previously ruled that gaming promoters’ commissions cannot exceed 1.25% of the (rolling) net amount of the conversion of gambling chips, whatever the calculation basis for converting those chips may be. Kwok has advised gaming promoters to examine their balance sheets, as mass markets will be the driving force of the industry. “The clientele is just not as great and diverse as before. They don’t even set foot in their market anymore. In the past when the profits were higher, junkets would take the initiative to search for customers. Now, with less profit on offer, they won’t make the initiative. This makes the market even smaller,” Kwok told the public broadcaster. The government estimates gambling revenue this year will be MOP216 billion, which the two gaming experts believe will be achieved. Fitch Ratings, however, said in a previous forecast that Macau’s gaming industry will reach some MOP231 billion in revenue. The American credit rating agency expects local gaming revenue to recover in 2024 to 79% of the level seen back in 2019 (pre-pandemic). At that time, casino revenues made, according to figures from the DICJ, an accumulated MOP292.455 billion. |

|

|

|

Post by Blitz on Jan 15, 2024 6:17:52 GMT -5

Citi: New premium mass area at Melco’s Studio City showing early strength Ben Blaschke - Mon 15 Jan 2024 at 15:21 www.asgam.com/index.php/2024/01/15/citi-new-premium-mass-area-at-melcos-studio-city-showing-early-strength/A recently opened premium mass gaming room located in the Epic Tower of Melco Resorts’ Studio City Phase 2 development is already one of Macau’s top performing gaming spaces, according to financial services group Citi. In their monthly survey, Citi analysts George Choi and Ryan Cheung said the new Qilong Club at Studio City ranked second in wager per player amongst the premium mass rooms it surveyed, with 17 players present at the time including five “whales” wagering between HK$100,000 and HK$270,000 (US$12,780 and US$34,530) per hand. Average wager per player between the 17 players was HK$61,294. With 98 more premium mass baccarat tables in operation Macau-wide in January – of which 55 were split between Melco’s Qilong Club and Galaxy Macau’s Pavilion South – total wager observed in the city’s premium mass rooms grew by 26% month-on-month, indicating that “players’ passion for gaming does not seem to be impacted by the current state of the Chinese economy.” Choi and Cheung added that there were 534 premium mass players witnessed, up 34% from the 404 seen in December and 5% higher than during the October 2023 Golden Week holiday period. “The quality of the player we saw measured in terms of wager per player remains largely unchanged,” they wrote. “The number of whales we saw in January was 27, compared with 20 in December 2023.” The analysts also took note of a new “insurance” bet being used on some baccarat tables at both of MGM China’s properties – MGM Macau and MGM Cotai. While a similar bet has previously been witnessed at Malaysia’s Resorts World Genting, it hasn’t been seen anywhere else in Macau but has the potential to catch on much like the now popular “Lucky 6” bet, Choi and Cheung said. “If this insurance bet is perceived by players as an effective way to minimize losses and gains popularity amongst players (like the ‘Lucky 6’ bet), this will enhance house advantage, just like any other exotic bets in any casino game.” |

|

|

|

Post by Blitz on Jan 17, 2024 8:59:28 GMT -5

Macau VIP play rises in 4Q23 to $1.57B, marking best quarter since the pandemic agbrief.com/news/macau/17/01/2024/macau-vip-play-rises-4q23-marking-best-quarter/VIP play in Macau during the fourth quarter of last year actually saw a sequential uptick, rising by nearly 8 percent to MOP12.7 billion ($1.57 billion). The figure marked the best quarter for VIP play since the fourth quarter of 2019, before the pandemic. The uptick comes despite the Macau government’s push to move towards a mass market model and away from junkets. In 2019, the sector brought in some MOP135.22 billion ($16.76 billion) – according to data on VIP Baccarat play from the Gaming Inspection and Coordination Bureau (DICJ). This figure has fallen to MOP45.18 billion ($5.6 billion) in 2023. Meanwhile non-VIP Baccarat play rose to some MOP110.49 billion ($13.7 billion) in 2023, with the fourth quarter results topping even those of 4Q19, at MOP33.53 billion ($4.16 billion). Alidad Tash, Managing Director, 2NT8 Limited Alidad Tash, Managing Director of 2NT8 Limited, notes that “The percentage of VIP baccarat out of overall GGR continues to shrink. In the fourth quarter of 2023, it reached 23.5 percent, a far cry from 46 percent in 2019 and 66 percent in 2013.” And given the SAR’s changing gaming dynamics, the expert notes that “the number is expected to continue decreasing over the next few years as the emphasis shifts to mass and non-gaming patrons.” According to analysts at Deutsche Bank, mass table games accounted for some 75.2 percent of total table revenue in the fourth quarter, a slight uptick sequentially but a strong rise from the 52.7 percent they contributed in 4Q19. This comes as VIP GGR rose 7.9 percent quarterly, despite having fallen 60.7 percent when compared to 4Q19. Mass, including slots was up 4 percent when compared to 4Q19 and rose by 11.8 percent compared to the previous quarter. Total GGR during the year from casinos amounted to MOP183.05 billion ($22.7 billion), with the fourth quarter contributing some MOP54.11 billion ($6.71 billion).  Macau’s 10-year gaming licenses commenced on January 1st of 2023, with the SAR finally opening its borders after nearly three years of closure due to COVID. Meanwhile, non-casino gaming – including lottery, horse racing and sports betting – rose just 1.8 percent yearly in 2023, totaling MOP6.38 billion ($790.9 million). The fourth quarter contributed the most, at MOP1.7 billion ($210.7 million), but the sector has failed to rise to the figures seen pre-pandemic. Football betting was the strongest contributor, at MOP3.85 billion ($477.2 million), while basketball betting revenue was MOP2.26 billion ($280.15 million), both slight upticks yearly but falling short of pre-pandemic values. Horse racing brought in just MOP199 million ($24.67 million) during the year, in what is likely to be the final year of its operation. The Macau government announced that the Macau Jockey Club is forfeiting its concession and its land will return to the government by April 1st of 2024. Racing activities are supposed to end by March 31st of this year. |

|

|

|

Post by birdnest on Jan 18, 2024 20:09:42 GMT -5

So, I didn’t know you were back in LVS I thought you got out a while ago? Maybe I missed a post or you recently got back in? I know Blitz got out of it too.

Anyway what’s your thoughts on MLCO. It by far has been the most punished casino stock and hopefully can make ground up since Macau is making a come back.

|

|