Post by Blitz on Oct 12, 2023 7:41:30 GMT -5

Eni Eyes FID on Second FLNG Project in Mozambique in 2024

Nov 21, 2022

brazilenergyinsight.com/2023/10/11/eni-eyes-fid-on-second-flng-project-in-mozambique-in-2024/#more-58693

(Reuters) Italy’s Eni hopes to reach a final investment decision on its second floating liquefied natural gas (LNG) project in Mozambique by the end of June next year, two sources directly involved with the project said on Tuesday.

Its first LNG project – called Coral Sul – made the impoverished African country a global producer and exporter of LNG from November and the new project would further bolster Mozambique’s output.

This could also boost Eni’s gas output from Africa which it can transfer to Europe, helping diversify Europe’s gas sourcing in the next few years, its CEO Claudio Descalzi said in January.

“Job done? Not yet. It is 90% done, and we are aiming to have the FID (final investment decision) during H1 in 2024,” one of the sources said, adding the floating LNG ship would start producing and exporting within four years.

He did not wish to be named as he is not authorized to speak on investment timelines.

Descalzi and Italian Prime Minister Giorgia Meloni will travel to Mozambique and the Republic of the Congo later this week to strengthen ties between Italy and those countries, where Eni is developing LNG ventures, an Italian government source said, adding they were not expected to sign any new energy deals.

A final investment decision is a point in a project’s development where a major investment commitment is taken and is effectively seen as the final go-ahead.

Eni is the operator of Coral Sul, more than two-thirds of which is jointly owned by Eni, Exxon Mobil and China’s CNPC. Portuguese energy firm Galp, Korean Gas Corp. and Mozambique’s state oil company ENH are the minority partners with 10% each.

The gas field located in Mozambique’s offshore Rovuma basin, called Coral field, is estimated to hold 500 billion cubic meters of natural gas. Coral Sul is currently producing 3.5 million metric tons of LNG, and the new LNG ship could double the output, the source said. The joint venture partners could take time to agree on investment, but it is mostly “ready to go,” he said.

“If there is an item where the JV is fully aligned, it is on the equity lifting,” the source said, meaning the partners would take a share of production in proportion to their equity stakes.

/////////////////////

Background information:

Is floating LNG the key to unlocking the Rovuma Basin’s full potential?

BLOG Nov 21, 2022

www.spglobal.com/commodityinsights/en/ci/research-analysis/is-floating-lng-the-key-to-unlocking-the-rovuma-basin-potential.html

Mozambique's first cargo introduces East Africa as a new LNG export region Eni's Coral South floating liquified natural gas (FLNG) project offshore Mozambique has started up, with the first cargo leaving the Coral Sul liquefaction vessel in Area 4 - offshore Mozambique's northern Cabo Delgado Province - in mid-November. Start-up of the project (operated by Eni on behalf of its partners ExxonMobil, CNPC, GALP, KOGAS and ENH) adds Mozambique to list of global LNG-producing countries, and should eventually be transformational for the country's economy. Exports from the Coral South field are expected to be 3.4 million metric tonnes per annum (MMtpa), which will be purchased by BP under a 20-year contract with a 10-year extension clause, allowing for flexibility across global markets.

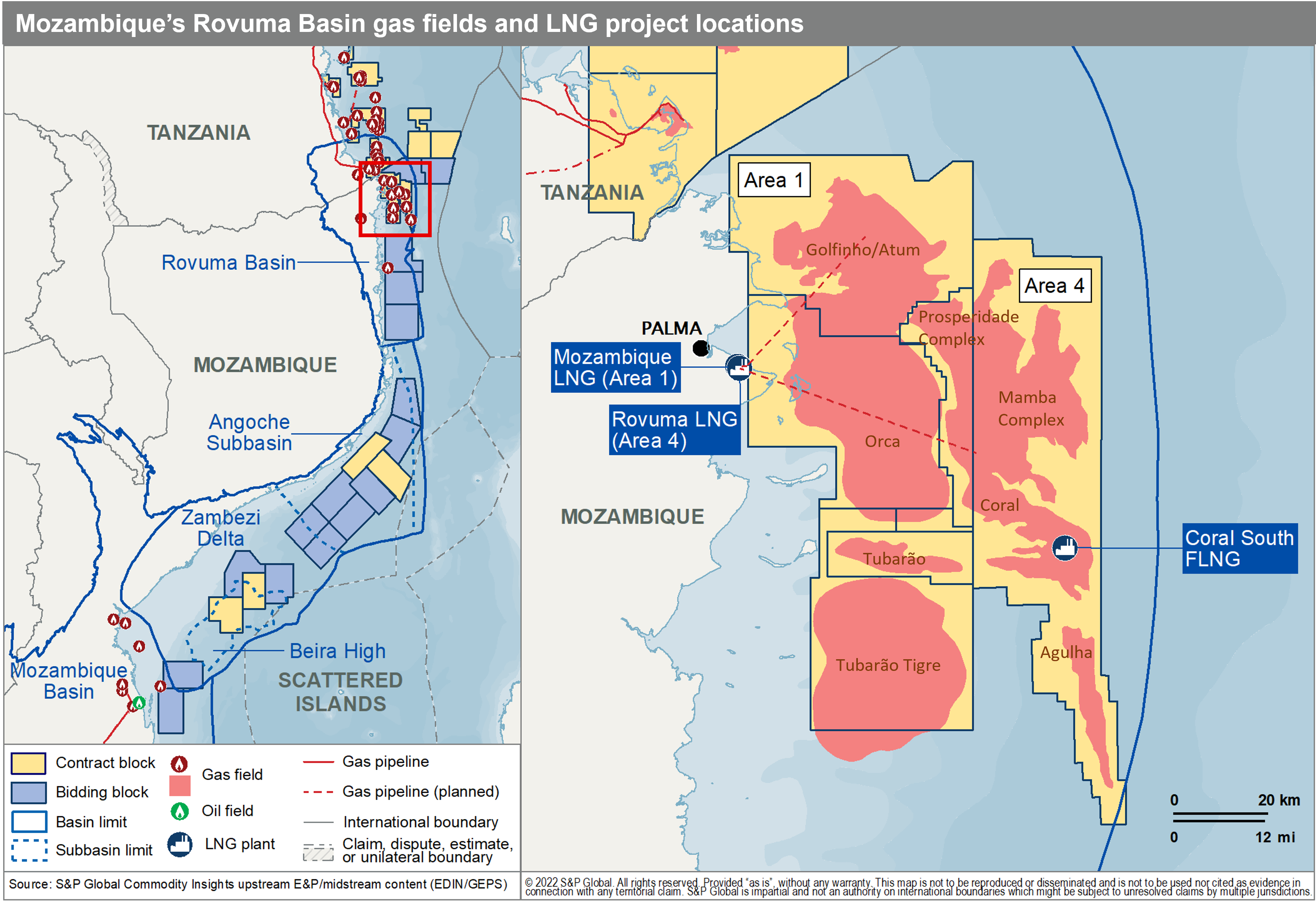

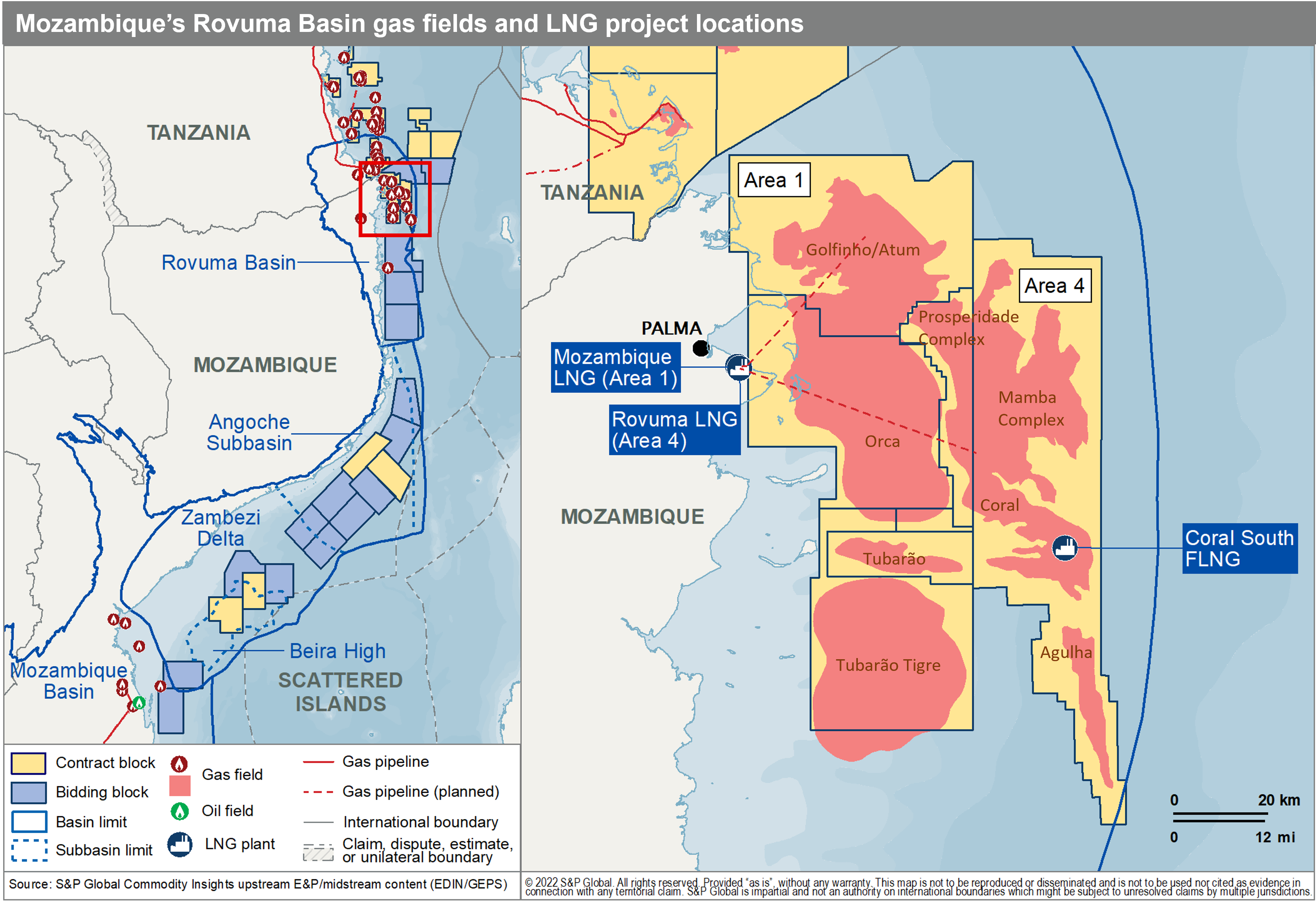

The deepwater Rovuma Basin will feed Coral South and subsequent LNG projects

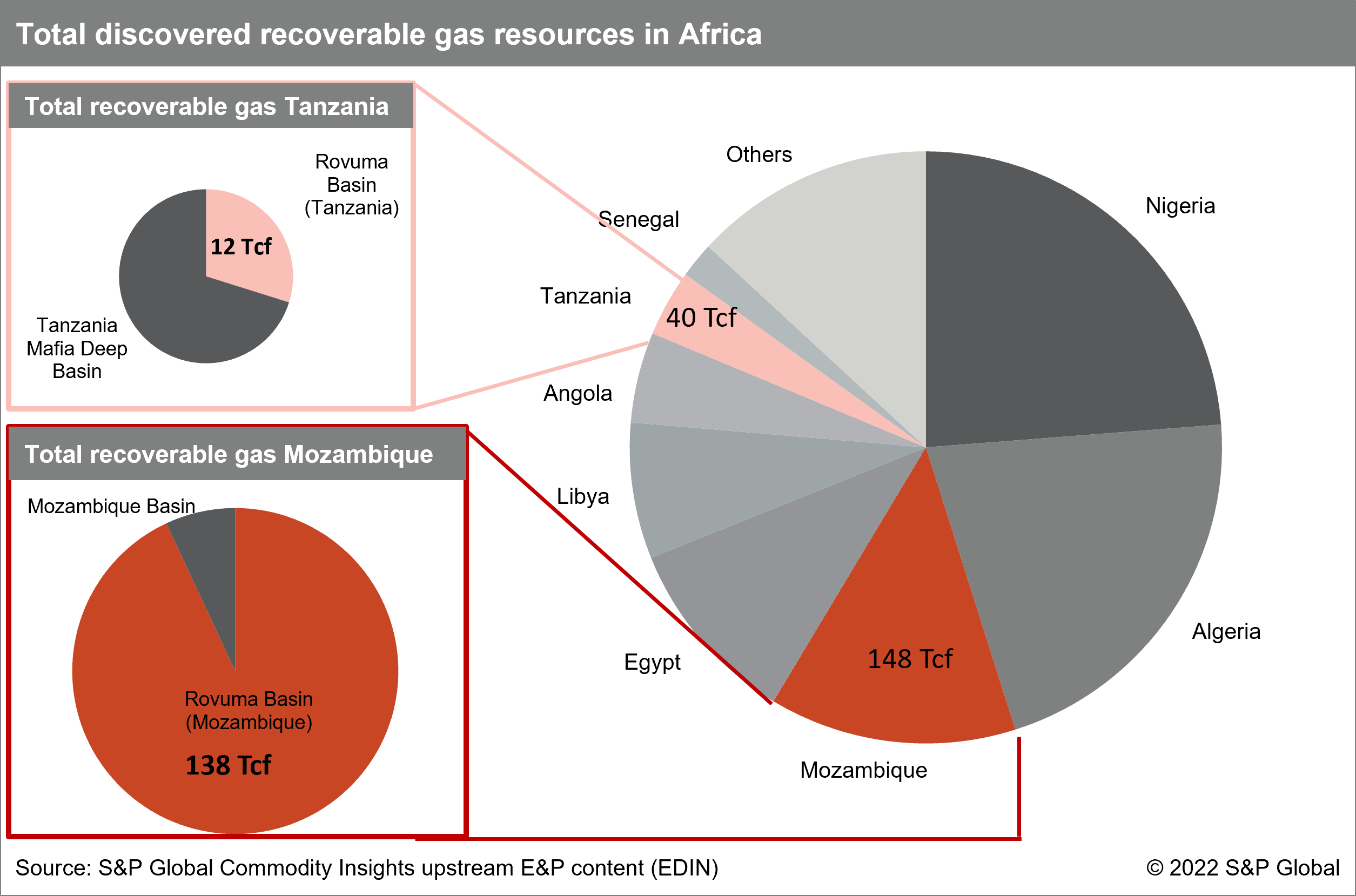

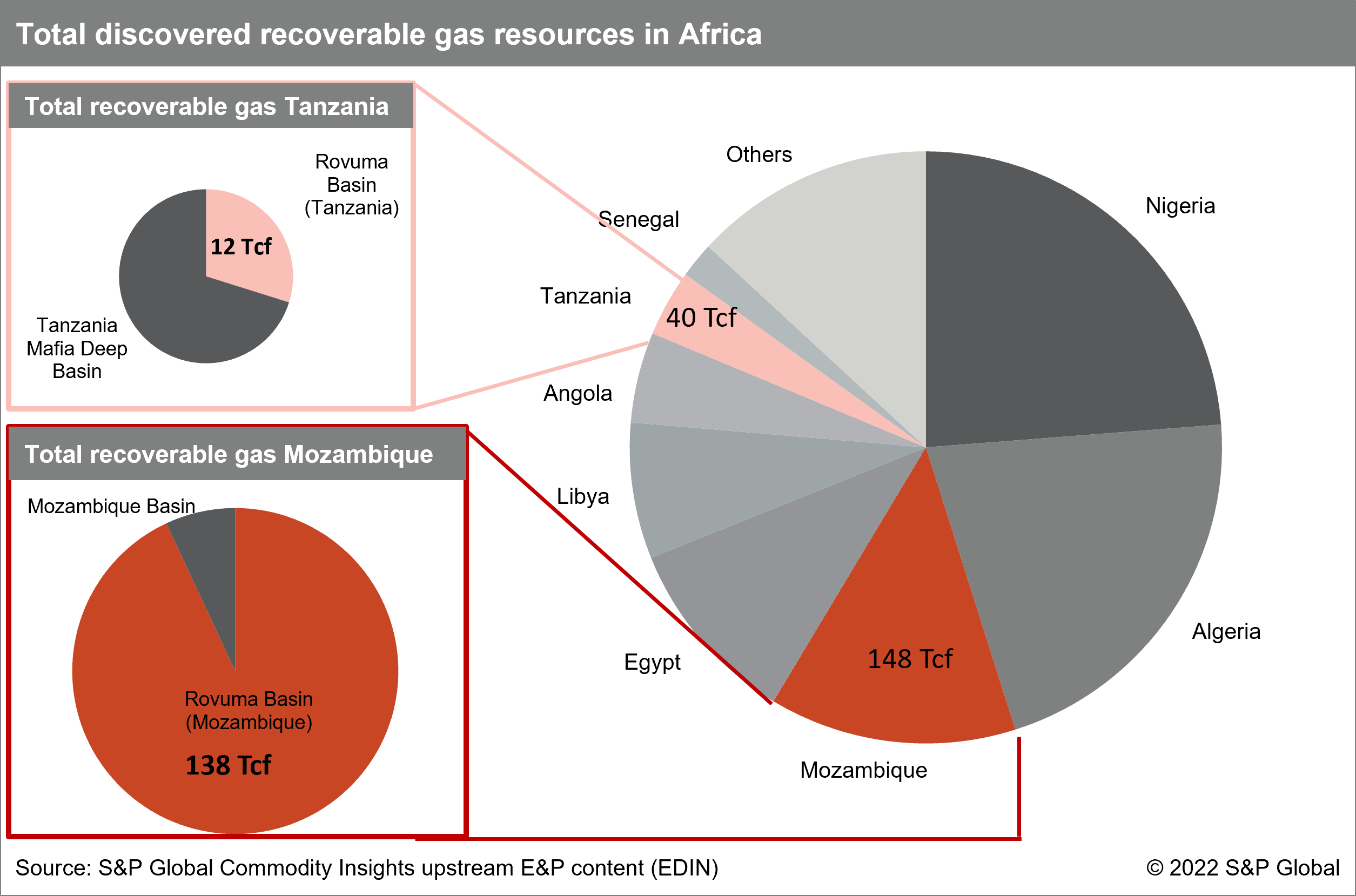

Supergiant natural gas discoveries during the first three years of offshore exploratory campaigns in the Rovuma Basin in 2010-13 include the Prosperidade, Mamba and Golfinho/Atum field complexes. An estimated 12 trillion cubic feet (Tcf) of recoverable gas resources were discovered by Eni in the Coral field in 2012. At 2,000 m water depth, the Coral South project is the first FLNG facility to be deployed in deepwater offshore Africa and it is the deepest water FLNG production facility globally. Mozambique ranks third in Africa in terms of total recoverable gas resources, with 148 Tcf discovered within the Rovuma and Mozambique Basins (138 Tcf and 10 Tcf respectively), ultimately making up 14% of total recoverable gas discovered on the continent. At current resource estimates, Mozambique has the potential to export around 60 MMtpa of LNG once both Area 1 and Area 4 are fully developed.

Further north, prolonged negotiations in Tanzania have delayed a final investment decision (FID) on an onshore plant that would monetise deepwater gas discoveries made by Equinor and Shell. Twelve Tcf recoverable gas resides in Tanzania, with 10 Tcf still undeveloped offshore. Should discussions allow for a Host Government Agreement (HGA) on fiscal package and profit-sharing conditions by end-2022, a January 2025 target for FID would allow for around 10 MMtpa of Tanzanian LNG supplementing Mozambique's exports by 2030, boosting East Africa as a global gas supplier.

A second FLNG project could emerge in Area 4 amid onshore security challenges

Despite Mozambique's vast offshore gas reserves, production has been slow to materialize, and Mozambique's developing LNG sector is already being reshaped as domestic above-ground risks and global gas markets evolve. The offshore location of the Coral South FLNG project (Area 4) has mostly insulated it from the ongoing Islamist insurgency in Cabo Delgado province, which has stalled the development of larger onshore liquefaction projects fed by gas discoveries offshore Area 1 (TotalEnergies operated Mozambique LNG) and Area 4 (ExxonMobil and Eni operated Rovuma LNG). Coral South has taken eight years to reach first production since the final exploration well was drilled in 2014, but it remains well ahead of the onshore plants, which face ongoing delays mainly due to security concerns. First gas was sent to the Coral Sul FLNG unit in June this year after achieving FID in 2017. Eni and ExxonMobil therefore are reassessing how to monetize the 80 Tcf of gas reserves in offshore Area 4 more quickly, efficiently, and safely, with FLNG likely to take near-term priority over the still-unsanctioned Rovuma LNG onshore plant. Eni confirmed in late July that it is considering a new 2.5-3 MMtpa Area 4 FLNG project, as volumes in the Coral and Agulha fields may be sufficient to support the proposed new liquefaction vessel. Investors clearly are focused on monetizing proven resources over attempting to discover more gas in the basin. Mozambique's upstream regulator, the National Petroleum Institute (INP) has announced that no suitable bids were received for Rovuma Basin licenses on offer in Mozambique's 6th License round; whereas six blocks received successful bids from Eni (one license) and CNOOC (5 licenses) in the Angoche and northern Mozambique basins respectively.

FLNG offers pragmatic solution to project development challenges

FLNG technology offers Mozambique a near-term solution to gas monetisation amid security challenges, but it is still a relatively nascent technology, with uncertainty regarding project utilization rates, maintenance and operational costs in varying ultra-deepwater sea and weather conditions. It also offers little in terms of domestic employment or gas supply, marking a trade-off between domestic economic development and expediting revenue flows from exports. That said, for now FLNG remains the key enabler for Mozambique's Rovuma Basin gas monetization. The technology is increasingly quick to deploy and allows operators to largely circumvent certain above-ground risks. FLNG's ability to monetize both large resources and more marginal fields means it will be increasingly applied more widely across Africa, with additional projects planned in the Equatorial Guinea, Republic of the Congo, and Senegal.

Nov 21, 2022

brazilenergyinsight.com/2023/10/11/eni-eyes-fid-on-second-flng-project-in-mozambique-in-2024/#more-58693

(Reuters) Italy’s Eni hopes to reach a final investment decision on its second floating liquefied natural gas (LNG) project in Mozambique by the end of June next year, two sources directly involved with the project said on Tuesday.

Its first LNG project – called Coral Sul – made the impoverished African country a global producer and exporter of LNG from November and the new project would further bolster Mozambique’s output.

This could also boost Eni’s gas output from Africa which it can transfer to Europe, helping diversify Europe’s gas sourcing in the next few years, its CEO Claudio Descalzi said in January.

“Job done? Not yet. It is 90% done, and we are aiming to have the FID (final investment decision) during H1 in 2024,” one of the sources said, adding the floating LNG ship would start producing and exporting within four years.

He did not wish to be named as he is not authorized to speak on investment timelines.

Descalzi and Italian Prime Minister Giorgia Meloni will travel to Mozambique and the Republic of the Congo later this week to strengthen ties between Italy and those countries, where Eni is developing LNG ventures, an Italian government source said, adding they were not expected to sign any new energy deals.

A final investment decision is a point in a project’s development where a major investment commitment is taken and is effectively seen as the final go-ahead.

Eni is the operator of Coral Sul, more than two-thirds of which is jointly owned by Eni, Exxon Mobil and China’s CNPC. Portuguese energy firm Galp, Korean Gas Corp. and Mozambique’s state oil company ENH are the minority partners with 10% each.

The gas field located in Mozambique’s offshore Rovuma basin, called Coral field, is estimated to hold 500 billion cubic meters of natural gas. Coral Sul is currently producing 3.5 million metric tons of LNG, and the new LNG ship could double the output, the source said. The joint venture partners could take time to agree on investment, but it is mostly “ready to go,” he said.

“If there is an item where the JV is fully aligned, it is on the equity lifting,” the source said, meaning the partners would take a share of production in proportion to their equity stakes.

/////////////////////

Background information:

Is floating LNG the key to unlocking the Rovuma Basin’s full potential?

BLOG Nov 21, 2022

www.spglobal.com/commodityinsights/en/ci/research-analysis/is-floating-lng-the-key-to-unlocking-the-rovuma-basin-potential.html

Mozambique's first cargo introduces East Africa as a new LNG export region Eni's Coral South floating liquified natural gas (FLNG) project offshore Mozambique has started up, with the first cargo leaving the Coral Sul liquefaction vessel in Area 4 - offshore Mozambique's northern Cabo Delgado Province - in mid-November. Start-up of the project (operated by Eni on behalf of its partners ExxonMobil, CNPC, GALP, KOGAS and ENH) adds Mozambique to list of global LNG-producing countries, and should eventually be transformational for the country's economy. Exports from the Coral South field are expected to be 3.4 million metric tonnes per annum (MMtpa), which will be purchased by BP under a 20-year contract with a 10-year extension clause, allowing for flexibility across global markets.

The deepwater Rovuma Basin will feed Coral South and subsequent LNG projects

Supergiant natural gas discoveries during the first three years of offshore exploratory campaigns in the Rovuma Basin in 2010-13 include the Prosperidade, Mamba and Golfinho/Atum field complexes. An estimated 12 trillion cubic feet (Tcf) of recoverable gas resources were discovered by Eni in the Coral field in 2012. At 2,000 m water depth, the Coral South project is the first FLNG facility to be deployed in deepwater offshore Africa and it is the deepest water FLNG production facility globally. Mozambique ranks third in Africa in terms of total recoverable gas resources, with 148 Tcf discovered within the Rovuma and Mozambique Basins (138 Tcf and 10 Tcf respectively), ultimately making up 14% of total recoverable gas discovered on the continent. At current resource estimates, Mozambique has the potential to export around 60 MMtpa of LNG once both Area 1 and Area 4 are fully developed.

Further north, prolonged negotiations in Tanzania have delayed a final investment decision (FID) on an onshore plant that would monetise deepwater gas discoveries made by Equinor and Shell. Twelve Tcf recoverable gas resides in Tanzania, with 10 Tcf still undeveloped offshore. Should discussions allow for a Host Government Agreement (HGA) on fiscal package and profit-sharing conditions by end-2022, a January 2025 target for FID would allow for around 10 MMtpa of Tanzanian LNG supplementing Mozambique's exports by 2030, boosting East Africa as a global gas supplier.

A second FLNG project could emerge in Area 4 amid onshore security challenges

Despite Mozambique's vast offshore gas reserves, production has been slow to materialize, and Mozambique's developing LNG sector is already being reshaped as domestic above-ground risks and global gas markets evolve. The offshore location of the Coral South FLNG project (Area 4) has mostly insulated it from the ongoing Islamist insurgency in Cabo Delgado province, which has stalled the development of larger onshore liquefaction projects fed by gas discoveries offshore Area 1 (TotalEnergies operated Mozambique LNG) and Area 4 (ExxonMobil and Eni operated Rovuma LNG). Coral South has taken eight years to reach first production since the final exploration well was drilled in 2014, but it remains well ahead of the onshore plants, which face ongoing delays mainly due to security concerns. First gas was sent to the Coral Sul FLNG unit in June this year after achieving FID in 2017. Eni and ExxonMobil therefore are reassessing how to monetize the 80 Tcf of gas reserves in offshore Area 4 more quickly, efficiently, and safely, with FLNG likely to take near-term priority over the still-unsanctioned Rovuma LNG onshore plant. Eni confirmed in late July that it is considering a new 2.5-3 MMtpa Area 4 FLNG project, as volumes in the Coral and Agulha fields may be sufficient to support the proposed new liquefaction vessel. Investors clearly are focused on monetizing proven resources over attempting to discover more gas in the basin. Mozambique's upstream regulator, the National Petroleum Institute (INP) has announced that no suitable bids were received for Rovuma Basin licenses on offer in Mozambique's 6th License round; whereas six blocks received successful bids from Eni (one license) and CNOOC (5 licenses) in the Angoche and northern Mozambique basins respectively.

FLNG offers pragmatic solution to project development challenges

FLNG technology offers Mozambique a near-term solution to gas monetisation amid security challenges, but it is still a relatively nascent technology, with uncertainty regarding project utilization rates, maintenance and operational costs in varying ultra-deepwater sea and weather conditions. It also offers little in terms of domestic employment or gas supply, marking a trade-off between domestic economic development and expediting revenue flows from exports. That said, for now FLNG remains the key enabler for Mozambique's Rovuma Basin gas monetization. The technology is increasingly quick to deploy and allows operators to largely circumvent certain above-ground risks. FLNG's ability to monetize both large resources and more marginal fields means it will be increasingly applied more widely across Africa, with additional projects planned in the Equatorial Guinea, Republic of the Congo, and Senegal.