Post by Blitz on Dec 5, 2022 8:52:03 GMT -5

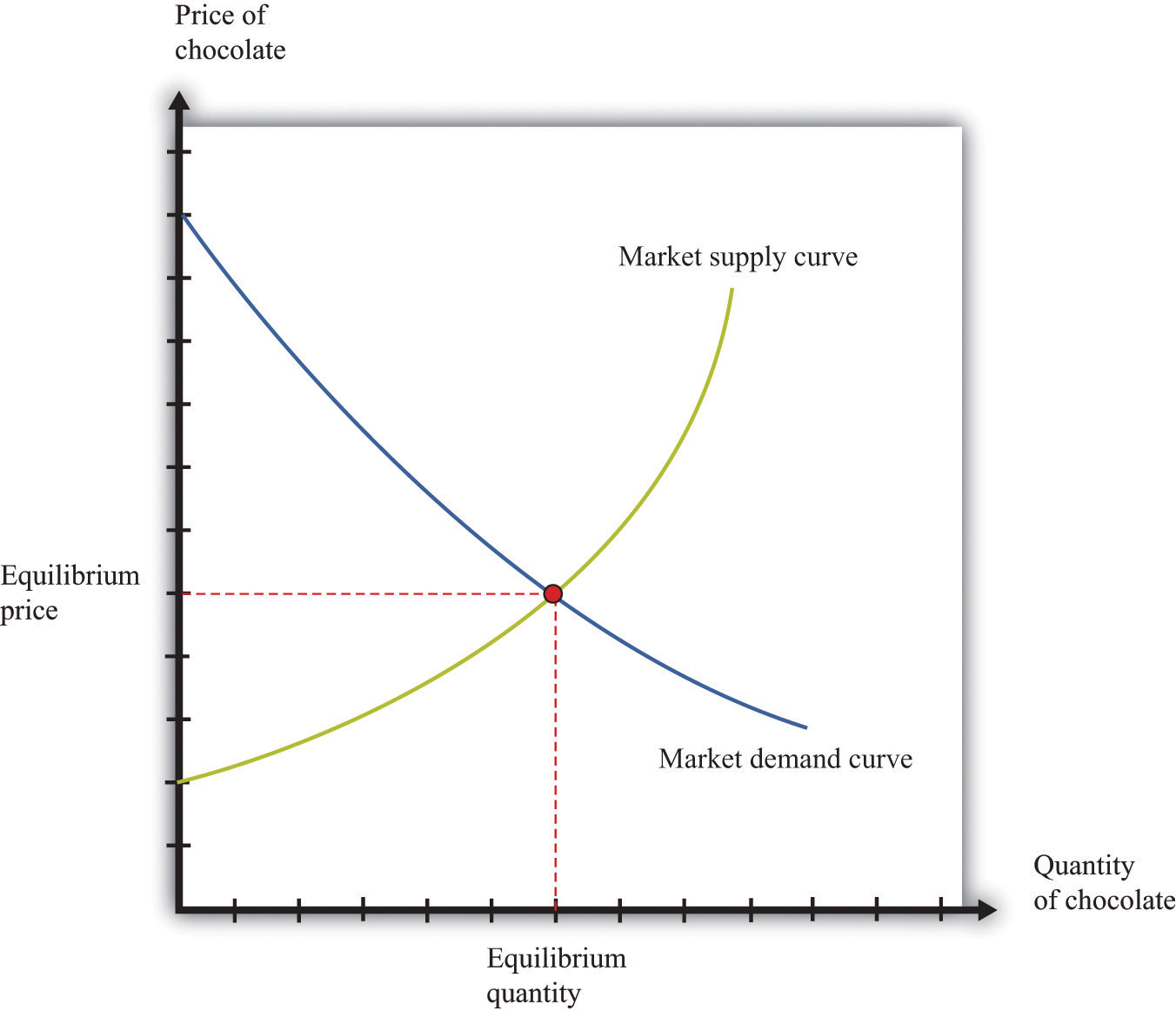

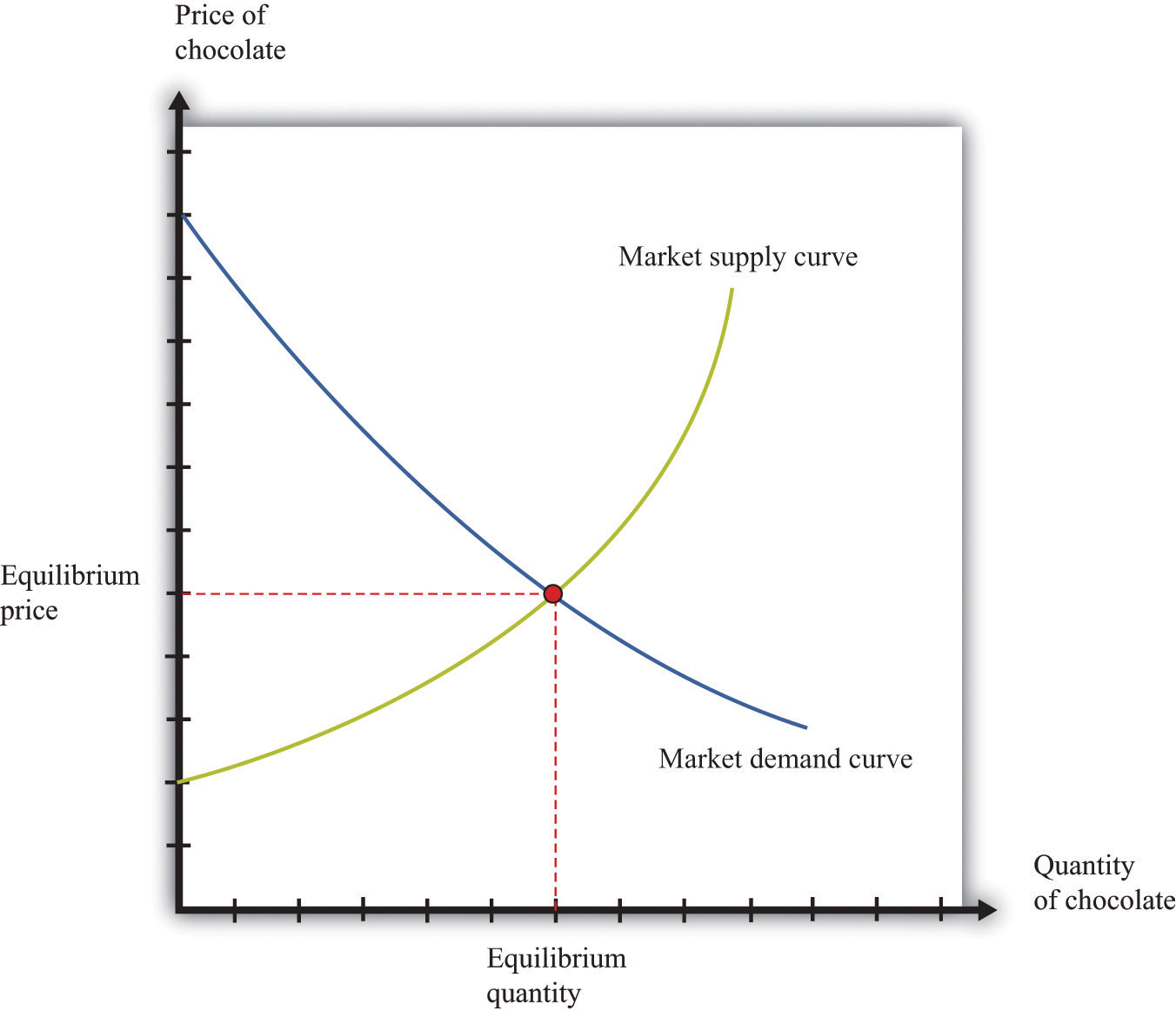

If this is not a 'head fake', and Xi actually eases zero-Covid restoring China's oil demand, this will shift the supply and demand curve to a higher equilibrium price... especially when you consider the SPR is as close to empty as it's ever been. Then what happens when team Biden decides to refill the SPR.

///////////////////////////

And now this...

Oil Prices Climb As China Continues To Ease Covid Restrictions

By Charles Kennedy - Dec 05, 2022, 1:35 AM CST

oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Climb-As-China-Continues-To-Ease-Covid-Restrictions.html

Crude oil prices climbed on Monday morning as Chinese cities continue to relax Covid restrictions now in their third year under the government’s zero-Covid policy.

However, reports of two Covid-related deaths in two different cities have emerged over the weekend and they may give authorities cause for being cautious about this relaxation.

The easing of restrictions came after protests broke out across several cities in the country, with some of them escalating to clashes with the police, after three years of lockdowns, travel restrictions, and rigorous testing.

Shanghai, Bloomberg reported this weekend, has scrapped PCR testing for entry into parks or the public transport from today, and Hangzhou will not longer require PCR tests for entry into most public places.

The relaxation drive has pushed oil prices higher as it is normally indicative of a pending rebound in oil demand as economic activity also rebounds. With new Covid cases in a decline after hitting a peak of 40,000, most of which were asymptomatic, at the end of last month, a relaxation was more or less inevitable.

It is very likely that the depression in economic activity was as much a motivator for the adjustment of the restrictions as the protests. One of the world’s power houses, China has already seen the effects of lockdowns on its growth and growth outlook and these effects have not been positive.

If the adjustments continue towards a greater reopening of the country, oil prices could climb higher still, especially with OPEC+’s decision to leave production caps in place and the G7 oil price cap on Russia entering into effect today together with the EU embargo on the commodity.

While it is early to talk about the end of Beijing’s zero-Covid policy, according to Goldman Sachs analysts, the current adjustments to this policy are “clear evidence of the Chinese government preparing for an exit, and trying to minimize the economic and social cost of Covid control in the meantime.”

By Charles Kennedy for Oilprice.com

///////////////////////////

And now this...

Oil Prices Climb As China Continues To Ease Covid Restrictions

By Charles Kennedy - Dec 05, 2022, 1:35 AM CST

oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Climb-As-China-Continues-To-Ease-Covid-Restrictions.html

Crude oil prices climbed on Monday morning as Chinese cities continue to relax Covid restrictions now in their third year under the government’s zero-Covid policy.

However, reports of two Covid-related deaths in two different cities have emerged over the weekend and they may give authorities cause for being cautious about this relaxation.

The easing of restrictions came after protests broke out across several cities in the country, with some of them escalating to clashes with the police, after three years of lockdowns, travel restrictions, and rigorous testing.

Shanghai, Bloomberg reported this weekend, has scrapped PCR testing for entry into parks or the public transport from today, and Hangzhou will not longer require PCR tests for entry into most public places.

The relaxation drive has pushed oil prices higher as it is normally indicative of a pending rebound in oil demand as economic activity also rebounds. With new Covid cases in a decline after hitting a peak of 40,000, most of which were asymptomatic, at the end of last month, a relaxation was more or less inevitable.

It is very likely that the depression in economic activity was as much a motivator for the adjustment of the restrictions as the protests. One of the world’s power houses, China has already seen the effects of lockdowns on its growth and growth outlook and these effects have not been positive.

If the adjustments continue towards a greater reopening of the country, oil prices could climb higher still, especially with OPEC+’s decision to leave production caps in place and the G7 oil price cap on Russia entering into effect today together with the EU embargo on the commodity.

While it is early to talk about the end of Beijing’s zero-Covid policy, according to Goldman Sachs analysts, the current adjustments to this policy are “clear evidence of the Chinese government preparing for an exit, and trying to minimize the economic and social cost of Covid control in the meantime.”

By Charles Kennedy for Oilprice.com