Post by Blitz on Jan 12, 2022 7:56:14 GMT -5

AGA'S COMMERCIAL GAMING REVENUE TRACKER

US gaming industry revenue sees 2nd-highest month in November, hits all-time high $48.34B in 2021

12 Jan 2021

www.yogonet.com/international/news/2022/01/11/60885-us-gaming-industry-revenue-sees-2ndhighest-month-in-november--hits-alltime-high--4834b-in-2021

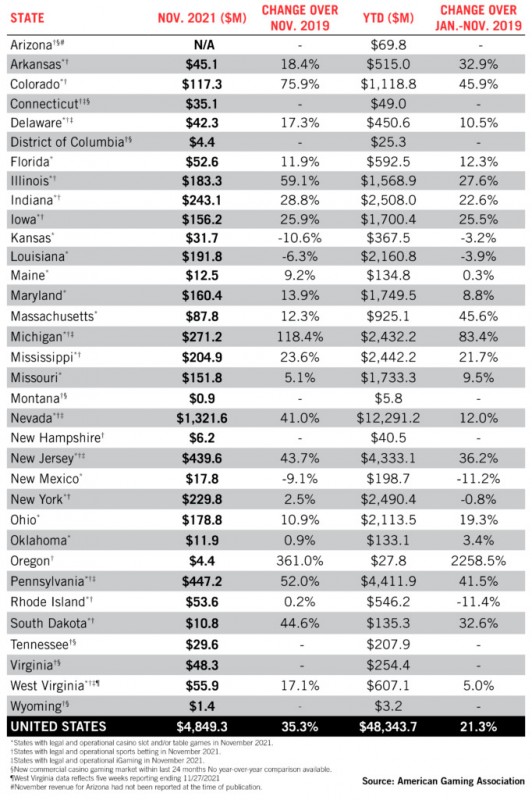

The American Gaming Association (AGA) released Monday its Commercial Gaming Revenue Tracker numbers, which feature state-by-state and nationwide financial performance data with breakdowns for individual gaming verticals for November 2021’s gaming revenue.

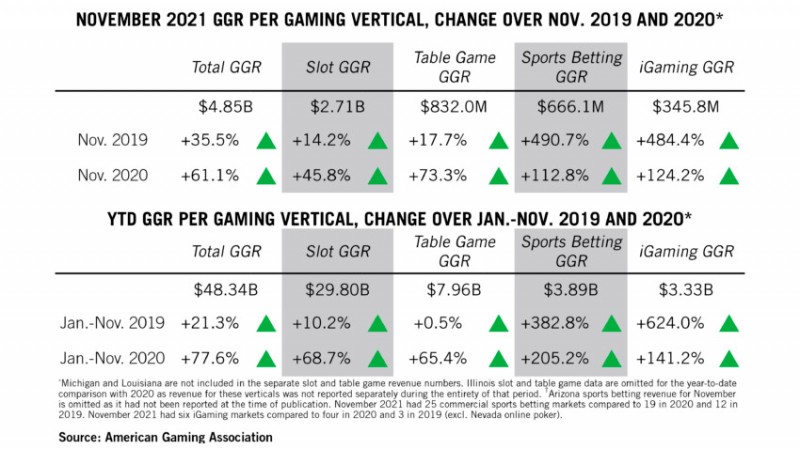

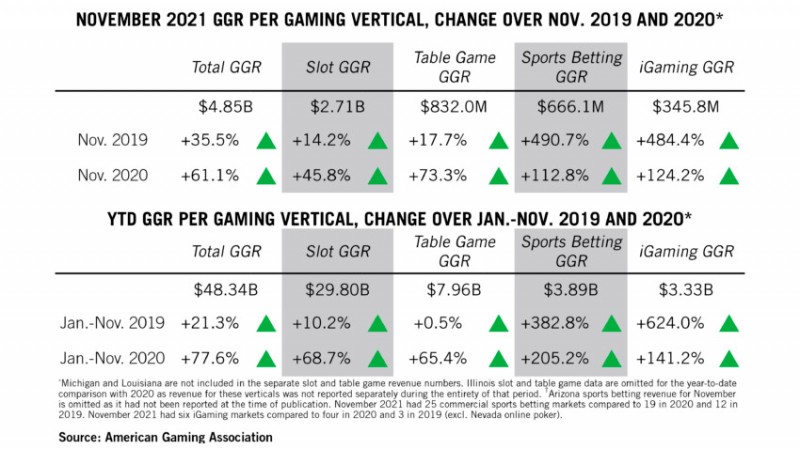

In the 11th month of the year, U.S. commercial gaming’s record-breaking momentum continued as the industry marked the second-highest grossing month ever. Combined revenue from traditional casino gaming, sports betting and iGaming reached $4.85 billion, growing 35.3% from November 2019, and up 1.3% from October 2021. Revenue from iGaming and sports betting accounted for 20.9% of the total, largely due to sportsbooks’ record month, driven by football.

Before 2021, monthly commercial gaming revenue had a solid $4 billion roof which had never been surpassed. November now marks the 9th consecutive month with comercial gaming revenue exceeding $4.4 billion.

Even though December’s revenue has not been reported yet, 2021 annual gaming revenue has reached $48.34 billion through the end of November, shattering the industry’s full-year record (2019) of $433.65 billion and tracking 21.3% ahead of the same eleven-month period in 2019.

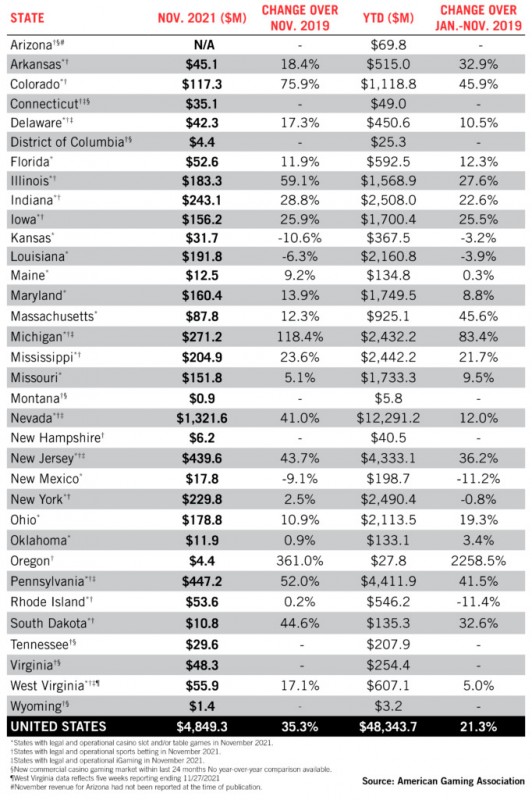

When it comes to each individual state, 23 of 26 commercial gaming jurisdictions that were operational in November 2019 saw revenue growth over that month, with monthly gaming win only declining in Kansas (-10.6%), Louisiana (-6.3%) and New Mexico (-9.1%).

By the end of November, 16 of 26 jurisdictions had exceeded 2019 full-year revenue and an additional five were tracking ahead of the same period of that year. Ten states have now surpassed their records for full-year gaming revenue: Arkansas, Colorado, Florida, Iowa, Massachusetts, Michigan, Oklahoma, Oregon, Pennsylvania and South Dakota.

Casino visitation and admission levels

Five regional markets have shown no change in their casino admission levels despite the start of the holiday season, and these are: Illinois, Iowa, Louisiana, Mississippi and Missouri. However, visitation levels remain notably below 2019’s.

Across the states, admission declines compared to November 2019 ranged from -17.6 to 30.4%, with the small sequential dip attributable to a less favorable calendar, as November had one less full weekend.

Las Vegas visitation decreased 11% from 2019, compared to -8% in October, according to the Las Vegas Convention and Visitors Authority.

Average gaming revenue from slots and table games per casino admission also exceeded pre-pandemic levels in November, with monthly casino win per visitor for the five states up between 10.1 and 37% from November 2019 averages.

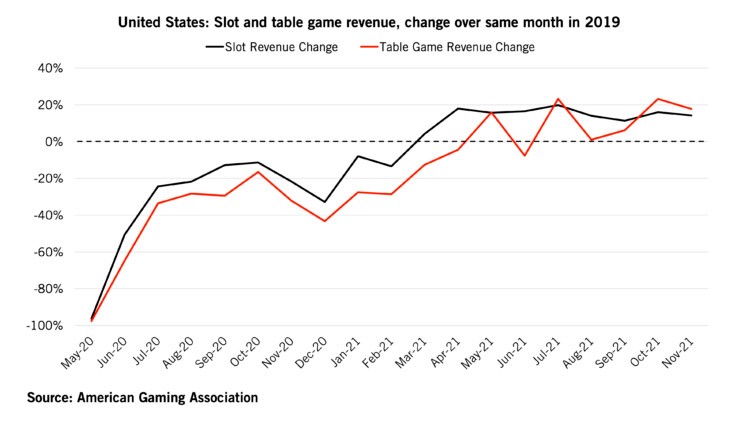

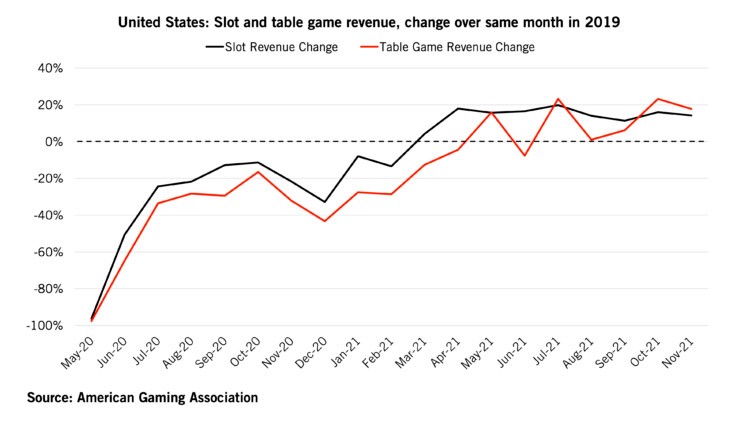

At a national level, brick-and-mortar slots and table games generated combined revenue of $3.83 billion, up 12.2% from November 2019, but dropping 3.6% sequentially. Slot revenue reached $2.71 billion, up 14.2% from 2019, while table games saw $832 million, an increase of 17.7% over 2019.

Year-to–date through November, slot and table game revenues reached $41.08 billion, close to the industry’s full-year record of $42.24 billion from 2019 and tracking 6.4% ahead of the same eleven-month period in that year.

At the state level, 17 of 25 commercial gaming states with slot and table gaming saw combined revenue from these verticals grow from November 2019, with 15 of the jurisdictions on track to surpass full-year slot and table game revenue.

Sports betting and iGaming

The football season propelled U.S. sports wagering, with the industry reporting its highest ever monthly revenue of $666.1 million, up 112.8% from November 2020 and shattering the previous record set in October by 48.5%.

The all-time high monthly revenue was driven by favorable event outcomes throughout the month as the nationwide hold percentage rose to 9.6%, up from 5.9% in October. U.S. handle reached $6.94 billion, down from $7.55 billion in October. The figures for November will increase further when Arizona data is released.

Sports betting in the eleventh month of the year was also buoyed by the first full month of wagering in Louisiana, with eight brick-and-mortar sportsbooks taking bets by the end of the month, generating $27.6 million in handle and $5.7 million in revenue.

iGaming in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia reached $345.8 million in November, up 124.4% year-over-year but contracting 3.2% from October’s record level.

Taken together, revenue from iGaming and sports betting accounted for 20.9% of total commercial gaming revenue in November, largely due to sportsbooks’ record month. That is the highest ever share for these verticals, except for April and May 2020 when nearly all casinos were shuttered.

US gaming industry revenue sees 2nd-highest month in November, hits all-time high $48.34B in 2021

12 Jan 2021

www.yogonet.com/international/news/2022/01/11/60885-us-gaming-industry-revenue-sees-2ndhighest-month-in-november--hits-alltime-high--4834b-in-2021

The American Gaming Association (AGA) released Monday its Commercial Gaming Revenue Tracker numbers, which feature state-by-state and nationwide financial performance data with breakdowns for individual gaming verticals for November 2021’s gaming revenue.

In the 11th month of the year, U.S. commercial gaming’s record-breaking momentum continued as the industry marked the second-highest grossing month ever. Combined revenue from traditional casino gaming, sports betting and iGaming reached $4.85 billion, growing 35.3% from November 2019, and up 1.3% from October 2021. Revenue from iGaming and sports betting accounted for 20.9% of the total, largely due to sportsbooks’ record month, driven by football.

Before 2021, monthly commercial gaming revenue had a solid $4 billion roof which had never been surpassed. November now marks the 9th consecutive month with comercial gaming revenue exceeding $4.4 billion.

Even though December’s revenue has not been reported yet, 2021 annual gaming revenue has reached $48.34 billion through the end of November, shattering the industry’s full-year record (2019) of $433.65 billion and tracking 21.3% ahead of the same eleven-month period in 2019.

When it comes to each individual state, 23 of 26 commercial gaming jurisdictions that were operational in November 2019 saw revenue growth over that month, with monthly gaming win only declining in Kansas (-10.6%), Louisiana (-6.3%) and New Mexico (-9.1%).

By the end of November, 16 of 26 jurisdictions had exceeded 2019 full-year revenue and an additional five were tracking ahead of the same period of that year. Ten states have now surpassed their records for full-year gaming revenue: Arkansas, Colorado, Florida, Iowa, Massachusetts, Michigan, Oklahoma, Oregon, Pennsylvania and South Dakota.

Casino visitation and admission levels

Five regional markets have shown no change in their casino admission levels despite the start of the holiday season, and these are: Illinois, Iowa, Louisiana, Mississippi and Missouri. However, visitation levels remain notably below 2019’s.

Across the states, admission declines compared to November 2019 ranged from -17.6 to 30.4%, with the small sequential dip attributable to a less favorable calendar, as November had one less full weekend.

Las Vegas visitation decreased 11% from 2019, compared to -8% in October, according to the Las Vegas Convention and Visitors Authority.

Average gaming revenue from slots and table games per casino admission also exceeded pre-pandemic levels in November, with monthly casino win per visitor for the five states up between 10.1 and 37% from November 2019 averages.

At a national level, brick-and-mortar slots and table games generated combined revenue of $3.83 billion, up 12.2% from November 2019, but dropping 3.6% sequentially. Slot revenue reached $2.71 billion, up 14.2% from 2019, while table games saw $832 million, an increase of 17.7% over 2019.

Year-to–date through November, slot and table game revenues reached $41.08 billion, close to the industry’s full-year record of $42.24 billion from 2019 and tracking 6.4% ahead of the same eleven-month period in that year.

At the state level, 17 of 25 commercial gaming states with slot and table gaming saw combined revenue from these verticals grow from November 2019, with 15 of the jurisdictions on track to surpass full-year slot and table game revenue.

Sports betting and iGaming

The football season propelled U.S. sports wagering, with the industry reporting its highest ever monthly revenue of $666.1 million, up 112.8% from November 2020 and shattering the previous record set in October by 48.5%.

The all-time high monthly revenue was driven by favorable event outcomes throughout the month as the nationwide hold percentage rose to 9.6%, up from 5.9% in October. U.S. handle reached $6.94 billion, down from $7.55 billion in October. The figures for November will increase further when Arizona data is released.

Sports betting in the eleventh month of the year was also buoyed by the first full month of wagering in Louisiana, with eight brick-and-mortar sportsbooks taking bets by the end of the month, generating $27.6 million in handle and $5.7 million in revenue.

iGaming in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia reached $345.8 million in November, up 124.4% year-over-year but contracting 3.2% from October’s record level.

Taken together, revenue from iGaming and sports betting accounted for 20.9% of total commercial gaming revenue in November, largely due to sportsbooks’ record month. That is the highest ever share for these verticals, except for April and May 2020 when nearly all casinos were shuttered.