Post by Blitz on Jan 11, 2022 9:09:17 GMT -5

No evidence U.S. ops to be singled out by Macau govt: Fitch

Jan 11, 2022 - Newsdesk

www.ggrasia.com/no-evidence-u-s-ops-to-be-singled-out-by-macau-govt-fitch/

Fitch Ratings Inc says there “is no obvious evidence yet” that Macau casino operators that are majority controlled by United States-based firms “will be treated differently” from Chinese-controlled counterparts regarding an expected refreshment process over gaming rights in the city.

“The operating subsidiaries [of the U.S.-based firms] are ultimately owned by Hong Kong-listed public entities, are large local employers, have invested tens of billions of U.S. dollars in capital and consistently promoted the government’s social goals,” the ratings agency said in a report issued on Monday.

Fitch added that there were local and Chinese influential figures on the Hong Kong-listed boards of directors of Macau casino operators controlled by U.S. entities. It mentioned in particular Pansy Ho Chiu King, co-chairperson of Macau casino operator MGM China Holdings Ltd. The latter is controlled by U.S.-based firm MGM Resorts International.

Other Macau casino operators controlled by U.S. firms are Wynn Macau Ltd, a subsidiary of Wynn Resorts Ltd; and Sands China Ltd, majority owned by Las Vegas Sands Corp.

“All Macau operators have been supportive of broader local policy goals,” added Monday’s report from Fitch analysts Colin Mansfield, Samuel Hu and Connor Parks. “[Operators] have ensured employment through the pandemic despite meaningfully reduced revenue and paid billions in U.S. dollar-equivalent gaming taxes over the years.”

The ratings agency also noted that all Macau’s six casino concessionaires had “scored well” during a 2016 interim review by the city’s government.

Macau’s current six gaming concessions are due to expire in June this year. The Macau government has said it plans to launch a new public tender for Macau gaming rights, but the latter is due to be preceded by a new regulatory framework for the city’s gaming industry.

‘Negative’ watch

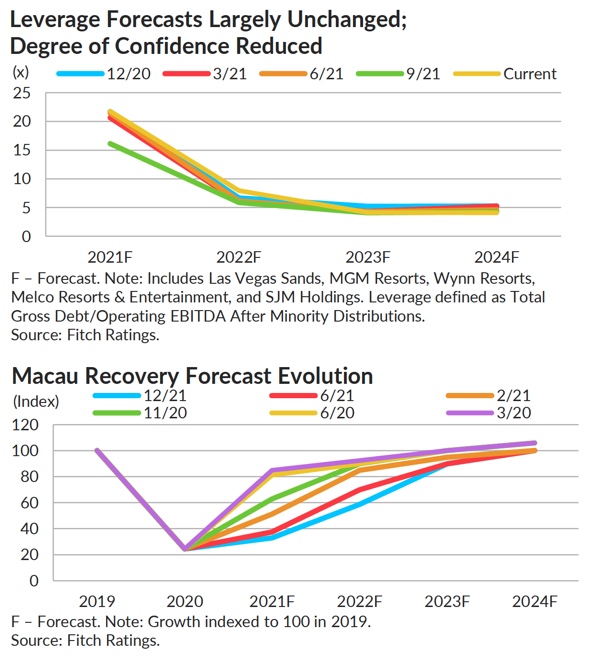

Fitch’s Monday report also gave additional commentary on why in early December it put Macau casino operator credit ratings and their associated “credit complexes” on “negative” watch. The rating agency cited as a key factor licence uncertainty, given that only six months remain for the lifetime of the current gaming concessions.

Fitch said it would “look to resolve” the ‘rating watch negative’ decisions once the Macau government “clarifies the new concession regulatory environment and there is greater certainty that an existing concessionaire has secured a new concession”.

But the document added: “Even if Fitch receives near-term clarity on the rebidding process and how the regulations will be set up, an operator securing a new concession will likely be required to resolve” the ‘rating watch negative’ decision.

The ratings house said that “no assurances can be made yet on what Macau’s future operating environment will look like, but Fitch still holds that the regulators will take a pragmatic approach given their preference for stability”.

The institution also observed, referring to Macau’s leader, Ho Iat Seng, and the possibility of extending the current Macau concessions in increments up to a maximum of five years: “Should the Chief Executive utilise the five-year extension option to June 2027, then the ratings would revert to primarily being driven by operating fundamentals.”

Zero-Covid policy

In the shorter term, the decision to put Macau gaming names on ‘rating watch negative’ took into account “the potential for negative rating actions” should there be signs that the recovery in visitor volume to Macau, “particularly from mainland China, and resultant gaming revenues, do not materialise as expected”.

According to several media reports, a number of local Covid-19 cases has been detected in the past few days in Shenzhen, Guangdong, near that mainland province’s border with Hong Kong. Macau also shares a border with Guangdong.

All ferry services between Macau and Shenzhen have been halted since Sunday (January 9), until further notice. The suspension was confirmed by the Macau government in a Saturday written announcement.

Since the start of the Covid-19 pandemic, Mainland China has been the only place to have a mostly quarantine-free travel arrangement with Macau. The Fitch analysts pointed out that “further travel integration” between the two places was expected during 2022.

“Since most of Macau’s visitors comes from China and Hong Kong, frictionless and quarantine-free travel would be a material positive for the gaming industry,” the report added. “However, China’s zero-Covid policy will make 2022 visitation extremely volatile given the typical temporary lockdowns implemented when a Covid case occurs, particularly if it occurs in Guangdong”.

Fitch also made reference in its report to the recent decline of the VIP junket segment in the Macau market.

“Pressures from the junket/VIP space are more medium-term in nature and could impact the overall market’s gross gaming revenue (GGR) recovery toward pre-pandemic levels, but this is a lesser credit concern given its lower cash flow contribution.”

Jan 11, 2022 - Newsdesk

www.ggrasia.com/no-evidence-u-s-ops-to-be-singled-out-by-macau-govt-fitch/

Fitch Ratings Inc says there “is no obvious evidence yet” that Macau casino operators that are majority controlled by United States-based firms “will be treated differently” from Chinese-controlled counterparts regarding an expected refreshment process over gaming rights in the city.

“The operating subsidiaries [of the U.S.-based firms] are ultimately owned by Hong Kong-listed public entities, are large local employers, have invested tens of billions of U.S. dollars in capital and consistently promoted the government’s social goals,” the ratings agency said in a report issued on Monday.

Fitch added that there were local and Chinese influential figures on the Hong Kong-listed boards of directors of Macau casino operators controlled by U.S. entities. It mentioned in particular Pansy Ho Chiu King, co-chairperson of Macau casino operator MGM China Holdings Ltd. The latter is controlled by U.S.-based firm MGM Resorts International.

Other Macau casino operators controlled by U.S. firms are Wynn Macau Ltd, a subsidiary of Wynn Resorts Ltd; and Sands China Ltd, majority owned by Las Vegas Sands Corp.

“All Macau operators have been supportive of broader local policy goals,” added Monday’s report from Fitch analysts Colin Mansfield, Samuel Hu and Connor Parks. “[Operators] have ensured employment through the pandemic despite meaningfully reduced revenue and paid billions in U.S. dollar-equivalent gaming taxes over the years.”

The ratings agency also noted that all Macau’s six casino concessionaires had “scored well” during a 2016 interim review by the city’s government.

Macau’s current six gaming concessions are due to expire in June this year. The Macau government has said it plans to launch a new public tender for Macau gaming rights, but the latter is due to be preceded by a new regulatory framework for the city’s gaming industry.

‘Negative’ watch

Fitch’s Monday report also gave additional commentary on why in early December it put Macau casino operator credit ratings and their associated “credit complexes” on “negative” watch. The rating agency cited as a key factor licence uncertainty, given that only six months remain for the lifetime of the current gaming concessions.

Fitch said it would “look to resolve” the ‘rating watch negative’ decisions once the Macau government “clarifies the new concession regulatory environment and there is greater certainty that an existing concessionaire has secured a new concession”.

But the document added: “Even if Fitch receives near-term clarity on the rebidding process and how the regulations will be set up, an operator securing a new concession will likely be required to resolve” the ‘rating watch negative’ decision.

The ratings house said that “no assurances can be made yet on what Macau’s future operating environment will look like, but Fitch still holds that the regulators will take a pragmatic approach given their preference for stability”.

The institution also observed, referring to Macau’s leader, Ho Iat Seng, and the possibility of extending the current Macau concessions in increments up to a maximum of five years: “Should the Chief Executive utilise the five-year extension option to June 2027, then the ratings would revert to primarily being driven by operating fundamentals.”

Zero-Covid policy

In the shorter term, the decision to put Macau gaming names on ‘rating watch negative’ took into account “the potential for negative rating actions” should there be signs that the recovery in visitor volume to Macau, “particularly from mainland China, and resultant gaming revenues, do not materialise as expected”.

According to several media reports, a number of local Covid-19 cases has been detected in the past few days in Shenzhen, Guangdong, near that mainland province’s border with Hong Kong. Macau also shares a border with Guangdong.

All ferry services between Macau and Shenzhen have been halted since Sunday (January 9), until further notice. The suspension was confirmed by the Macau government in a Saturday written announcement.

Since the start of the Covid-19 pandemic, Mainland China has been the only place to have a mostly quarantine-free travel arrangement with Macau. The Fitch analysts pointed out that “further travel integration” between the two places was expected during 2022.

“Since most of Macau’s visitors comes from China and Hong Kong, frictionless and quarantine-free travel would be a material positive for the gaming industry,” the report added. “However, China’s zero-Covid policy will make 2022 visitation extremely volatile given the typical temporary lockdowns implemented when a Covid case occurs, particularly if it occurs in Guangdong”.

Fitch also made reference in its report to the recent decline of the VIP junket segment in the Macau market.

“Pressures from the junket/VIP space are more medium-term in nature and could impact the overall market’s gross gaming revenue (GGR) recovery toward pre-pandemic levels, but this is a lesser credit concern given its lower cash flow contribution.”