Post by Blitz on Dec 16, 2021 20:11:12 GMT -5

Howard is echoing what this board has been saying... Rob has purchased no shares, he doesn't want to move to Singapore, he's in analysis paralysis while waiting to retire as great #2...

Las Vegas Sands: The Entry Point Gets More Attractive By The Day But Nobody Seems Interested

Dec. 16, 2021 - Howard Jay Klein

seekingalpha.com/article/4475647-las-vegas-sands-lvs-entry-point-more-attractive-nobody-interested

Summary

The hammering of LVS stock continues, raising a huge issue: Macau pandemic, regulatory and junket arrests of Suncity's Chau will either keep stock dead pooled or wake up bottom fishers.

The post Adelson management team faces tough choices. Either move on with something now with conviction or continue playing it safe waiting for better news from Asia. That's paralysis.

LVS needs to move on its targeted entry into sports betting even assuming Macau woes continue. We are lowering our PT guidance from $75-$8 by next year to $67.

"Often the difference between a successful person and a failure is not one has better abilities or ideas, but the courage that one has to bet on one's ideas, to take a calculated risk - and to act." - Andre Malraux

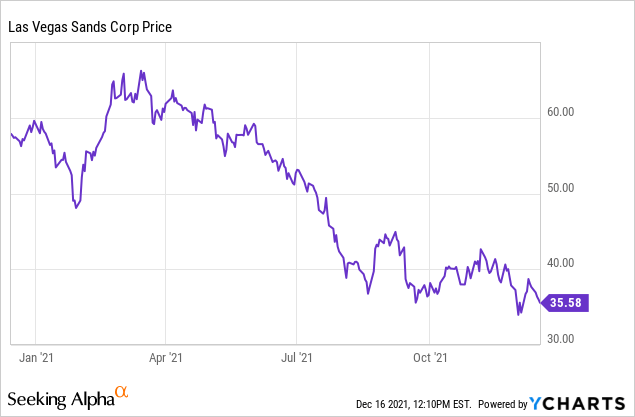

Readers of this space are familiar, and some won't let me forget it that I have been pounding the pavement for Las Vegas Sands (LVS) since it was trading at more than double its current range. In fact, I have been guiding the stock higher through the torrents of Macau travel restriction policies, China regulatory scares and critiques of its pivotal decision to sell its Vegas assets for $6.2b.

Data by YCharts

On top of that, there is a growing belief among many investors who have written me that the death of visionary founder Sheldon Adelson last January has robbed the company of the very qualities it possessed as expressed in the Andre Malraux quote above.

Against much dissent from many holders, I had held fast to my deep conviction that the bigger hammering LVS took, the niftier the discount off its real valuation became. So I kept my PT in place against what I perceived was a time frame ignited as soon as the China travel bans were considerably eased and pent up demand, I know is there, begins to show.

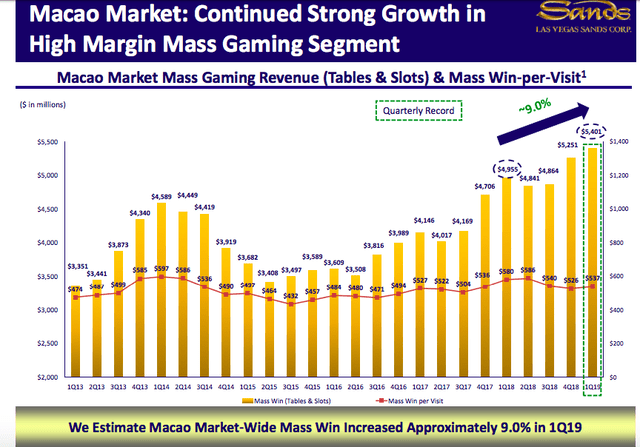

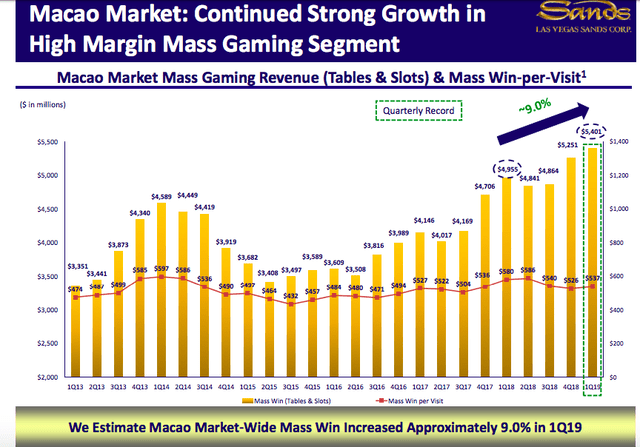

Below: This is what LVS looked like pre-pandemic. Pent up demand post-pandemic, whenever that begins to appear, will resume the upside.

Source: LVS

At the same time, my feeling was that Adelson's successors would sooner, rather than later, put down a big shoe footprint in online gaming with either an acquisition or an announcement of the formation of its own online unit backed by its savvy, its deep resource base, and most of all, it's Vegas and prior to that, Allentown, PA casino since sold to a tribal casino group.

Thus far nothing has happened. There is a plethora of reasons management can cite for the dead pool status of company initiatives since the death of Sheldon. And most of them are totally understandable.

One LVS target post Vegas was to either buy or develop an integrated resort in a third Asian nation. Now, a year later, with the pandemic still calling the shots, valuations are a tough ticket to estimate. Inflation has hit development costs.

Nobody knows how to value an existing property in Asia now with the pandemic still hanging over everyone's prospects.

Macau officials have also dropped a regulatory bomb that seems to suggest some kind of major incursion by government into the daily operations of casinos. So with all this uncertainty, if you were LVS, would a watch and wait posture make sense to you? Probably. As I have noted in prior articles, I have known successor CEO Rob Goldstein since our AC days. He is a skilled, smart manager with good instincts on timing. He has also talked about big possible moves in either New York or Texas for LVS. That's a waiting game that could take a decade to come to fruition. But that's going to be an unpredictable free for all.

So from the perspective of adding properties, I am giving LVS a free pass. But I also have come to believe that the slow-footed move into online and sports betting does not qualify for the self-same free pass. Management has had plenty of time to dig into the sector, to observe the competitive pressures and, of course, the exponential growth of revenues as more and more states legalize sports betting.

There could be some internal scuffling here that has delayed the possibility of LVS entering the sports betting fray. Everyone knows Sheldon was viscerally opposed to online gaming as a result of the damage his compulsive gambler father imposed on his family life. Furthermore, Sheldon was also on record as having been less than confident that even the most powerful firewalls could not stop tech-savvy teenagers from breaking into sites and becoming addictive gamblers.

After his death, his widow, Dr. Miriam Adelson, has on several occasions expressed her strong desire that her late husband's legacy needed to be sustained. As the company's most important shareholder through the family foundation, it could be possible that Dr. Adelson might be resisting a move to online. That could be a stretch of course. Her confidence in Goldstein and his number two, Patrick Dumont (her son-in-law), do occupy a favorable status in the company.

Above: The visionary is gone, but is part of his legacy still keeping present management away from plunging into digital gaming? Source: LVS archives.

But ear to the ground I have heard from industry colleagues that Goldstein, now in his sixties, made a multi-millionaire many times over by Adelson, maybe toying with the idea of serving through a transition to Dumont and then retiring to coupon cutting paradise somewhere back east near his and his wife's family homes.

Above: CEO Goldstein a savvy operator, but he could be presiding over mixed sentiment about right approach to online internally. Source: LVS archives.

The sports betting prospects need to be acted on to fulfill shareholders continuing confidence that the successor management has a firm handle on LVS's future

We don't imply here that a decision regarding an entry into sports betting by LVS is an easy one. The opportunities are clear and so are the pitfalls. The sector has soared and tanked since legalization in 2018. And that is just the point. Valuations were far too high for many stocks in the sector so a move on one of them would not seem smart. But now that the sector has come down to earth with a slow slog ahead to rebuilding value due to easing marketing costs, the values are aplenty.

If LVS wants to acquire a platform, there are numerous possibilities both in the US and UK, in particular. They have the cash, they have the stated desire to move into online and certainly the ability to sift through possibilities and make a deal.

Conversely, should they prefer to go at it from scratch, that should also pose no problem. The skill sets held by key operatives in the field are available for a price. The pick and shovel tech stack companies eager for a partnership can provide a turnkey functionality in a relatively short time frame.

The LVS brand, as it were, has strong enough resonance with gamblers due to its long history in Las Vegas to smooth the path to customer awareness.

We assume now, a year after Adelson left us, that LVS has engaged with many sports betting operatives and by now has a pretty solid idea of what may constitute its best possible path to entry. Nobody has suggested a mad rush. This could be an investment by the company that could run into the billions.

But from a shareholder's perspective, the process still appears to be taking far too long.

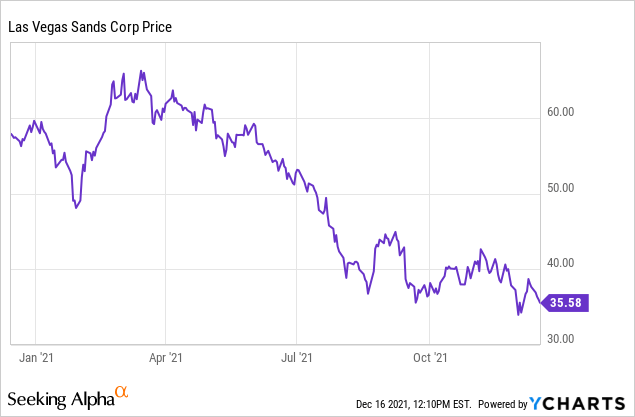

At writing, LVS is $37.07, down 11.62% from last month while the sector, in general, lost 2.08%.

Analysts expect earnings imminently released to hit $0.21 a share y/y better by 43.24%. If so, that's nice.

Revenue of $1.04b is down 9.4& y/y.

For the full 2021 year, analysts expect earnings of $1.8 a share on revenues of $4.43b.

We need not go into all the massive headwinds which have rattled the Asian gaming sector since the first outbreak of the pandemic. Briefly, we see total connective tissue between the pandemic and its Omicron eruption, ever louder rumblings from regulators in Macau about putting in place more intrusive policies of compliance. This has been compounded by the arrests two weeks ago of 11 junket operators for conducting illegal online betting for selected VIPs.

On top of that, we have the lingering woes expressed by some observers that Beijing will have a say in bringing forth further regulatory blasts connected with harsh re-concession mandates to come when decisions on re-licensing are made next June.

There is also the prospect that Beijing intends to keep its zero toleration Covid policy in place and subsequently its travel bans. With only 200 new cases of Omicron reported in one province, the government went immediately to lockdown.

Add further to this a slowing of the China economy and you have a recipe for the $37 a share range noted above.

So you have the base case rationale of many investors that LVS, despite its phenomenal asset bases in Macau and Singapore, its financial strength, its savvy management and post pandemic recovery in a pent-up demand market that will produce a share price considerably above where the stock sits now.

As it is now a totally Asian company, LVS has taken a disproportionate hit by all these headwinds.

While I do see an easing of travel ban pressures ahead, a far less damaging set of new regulations put in place and the strong prospect that all existing concessions will be renewed, I can no longer defend the PT I have in place at $70 to $80 by mid-year next.

Thus, I have posited a valuation of LVS finally making some kind of announcement of a move into sports betting that will hearten the confidence of holders and start the stock on an upward climb again.

I think a move in online that made sense and held strong prospects for success ahead for LVS in that space would be bullish enough to ignite entry at its current bargain price based on asset values alone. I say this in full cognizance that the sports betting sector is already overcrowded, its marketing and media a cascading Tower of Promotional Babble. But the LVS brand with strong identification among gamblers for decades supports an entry into the digital space.

I have baked in sports betting and perhaps some positive peeps from Asia and come up with a revised PT of $67 by 2Q22.

That looks like a pretty strong possible return from here.

Las Vegas Sands: The Entry Point Gets More Attractive By The Day But Nobody Seems Interested

Dec. 16, 2021 - Howard Jay Klein

seekingalpha.com/article/4475647-las-vegas-sands-lvs-entry-point-more-attractive-nobody-interested

Summary

The hammering of LVS stock continues, raising a huge issue: Macau pandemic, regulatory and junket arrests of Suncity's Chau will either keep stock dead pooled or wake up bottom fishers.

The post Adelson management team faces tough choices. Either move on with something now with conviction or continue playing it safe waiting for better news from Asia. That's paralysis.

LVS needs to move on its targeted entry into sports betting even assuming Macau woes continue. We are lowering our PT guidance from $75-$8 by next year to $67.

"Often the difference between a successful person and a failure is not one has better abilities or ideas, but the courage that one has to bet on one's ideas, to take a calculated risk - and to act." - Andre Malraux

Readers of this space are familiar, and some won't let me forget it that I have been pounding the pavement for Las Vegas Sands (LVS) since it was trading at more than double its current range. In fact, I have been guiding the stock higher through the torrents of Macau travel restriction policies, China regulatory scares and critiques of its pivotal decision to sell its Vegas assets for $6.2b.

Data by YCharts

On top of that, there is a growing belief among many investors who have written me that the death of visionary founder Sheldon Adelson last January has robbed the company of the very qualities it possessed as expressed in the Andre Malraux quote above.

Against much dissent from many holders, I had held fast to my deep conviction that the bigger hammering LVS took, the niftier the discount off its real valuation became. So I kept my PT in place against what I perceived was a time frame ignited as soon as the China travel bans were considerably eased and pent up demand, I know is there, begins to show.

Below: This is what LVS looked like pre-pandemic. Pent up demand post-pandemic, whenever that begins to appear, will resume the upside.

Source: LVS

At the same time, my feeling was that Adelson's successors would sooner, rather than later, put down a big shoe footprint in online gaming with either an acquisition or an announcement of the formation of its own online unit backed by its savvy, its deep resource base, and most of all, it's Vegas and prior to that, Allentown, PA casino since sold to a tribal casino group.

Thus far nothing has happened. There is a plethora of reasons management can cite for the dead pool status of company initiatives since the death of Sheldon. And most of them are totally understandable.

One LVS target post Vegas was to either buy or develop an integrated resort in a third Asian nation. Now, a year later, with the pandemic still calling the shots, valuations are a tough ticket to estimate. Inflation has hit development costs.

Nobody knows how to value an existing property in Asia now with the pandemic still hanging over everyone's prospects.

Macau officials have also dropped a regulatory bomb that seems to suggest some kind of major incursion by government into the daily operations of casinos. So with all this uncertainty, if you were LVS, would a watch and wait posture make sense to you? Probably. As I have noted in prior articles, I have known successor CEO Rob Goldstein since our AC days. He is a skilled, smart manager with good instincts on timing. He has also talked about big possible moves in either New York or Texas for LVS. That's a waiting game that could take a decade to come to fruition. But that's going to be an unpredictable free for all.

So from the perspective of adding properties, I am giving LVS a free pass. But I also have come to believe that the slow-footed move into online and sports betting does not qualify for the self-same free pass. Management has had plenty of time to dig into the sector, to observe the competitive pressures and, of course, the exponential growth of revenues as more and more states legalize sports betting.

There could be some internal scuffling here that has delayed the possibility of LVS entering the sports betting fray. Everyone knows Sheldon was viscerally opposed to online gaming as a result of the damage his compulsive gambler father imposed on his family life. Furthermore, Sheldon was also on record as having been less than confident that even the most powerful firewalls could not stop tech-savvy teenagers from breaking into sites and becoming addictive gamblers.

After his death, his widow, Dr. Miriam Adelson, has on several occasions expressed her strong desire that her late husband's legacy needed to be sustained. As the company's most important shareholder through the family foundation, it could be possible that Dr. Adelson might be resisting a move to online. That could be a stretch of course. Her confidence in Goldstein and his number two, Patrick Dumont (her son-in-law), do occupy a favorable status in the company.

Above: The visionary is gone, but is part of his legacy still keeping present management away from plunging into digital gaming? Source: LVS archives.

But ear to the ground I have heard from industry colleagues that Goldstein, now in his sixties, made a multi-millionaire many times over by Adelson, maybe toying with the idea of serving through a transition to Dumont and then retiring to coupon cutting paradise somewhere back east near his and his wife's family homes.

Above: CEO Goldstein a savvy operator, but he could be presiding over mixed sentiment about right approach to online internally. Source: LVS archives.

The sports betting prospects need to be acted on to fulfill shareholders continuing confidence that the successor management has a firm handle on LVS's future

We don't imply here that a decision regarding an entry into sports betting by LVS is an easy one. The opportunities are clear and so are the pitfalls. The sector has soared and tanked since legalization in 2018. And that is just the point. Valuations were far too high for many stocks in the sector so a move on one of them would not seem smart. But now that the sector has come down to earth with a slow slog ahead to rebuilding value due to easing marketing costs, the values are aplenty.

If LVS wants to acquire a platform, there are numerous possibilities both in the US and UK, in particular. They have the cash, they have the stated desire to move into online and certainly the ability to sift through possibilities and make a deal.

Conversely, should they prefer to go at it from scratch, that should also pose no problem. The skill sets held by key operatives in the field are available for a price. The pick and shovel tech stack companies eager for a partnership can provide a turnkey functionality in a relatively short time frame.

The LVS brand, as it were, has strong enough resonance with gamblers due to its long history in Las Vegas to smooth the path to customer awareness.

We assume now, a year after Adelson left us, that LVS has engaged with many sports betting operatives and by now has a pretty solid idea of what may constitute its best possible path to entry. Nobody has suggested a mad rush. This could be an investment by the company that could run into the billions.

But from a shareholder's perspective, the process still appears to be taking far too long.

At writing, LVS is $37.07, down 11.62% from last month while the sector, in general, lost 2.08%.

Analysts expect earnings imminently released to hit $0.21 a share y/y better by 43.24%. If so, that's nice.

Revenue of $1.04b is down 9.4& y/y.

For the full 2021 year, analysts expect earnings of $1.8 a share on revenues of $4.43b.

We need not go into all the massive headwinds which have rattled the Asian gaming sector since the first outbreak of the pandemic. Briefly, we see total connective tissue between the pandemic and its Omicron eruption, ever louder rumblings from regulators in Macau about putting in place more intrusive policies of compliance. This has been compounded by the arrests two weeks ago of 11 junket operators for conducting illegal online betting for selected VIPs.

On top of that, we have the lingering woes expressed by some observers that Beijing will have a say in bringing forth further regulatory blasts connected with harsh re-concession mandates to come when decisions on re-licensing are made next June.

There is also the prospect that Beijing intends to keep its zero toleration Covid policy in place and subsequently its travel bans. With only 200 new cases of Omicron reported in one province, the government went immediately to lockdown.

Add further to this a slowing of the China economy and you have a recipe for the $37 a share range noted above.

So you have the base case rationale of many investors that LVS, despite its phenomenal asset bases in Macau and Singapore, its financial strength, its savvy management and post pandemic recovery in a pent-up demand market that will produce a share price considerably above where the stock sits now.

As it is now a totally Asian company, LVS has taken a disproportionate hit by all these headwinds.

While I do see an easing of travel ban pressures ahead, a far less damaging set of new regulations put in place and the strong prospect that all existing concessions will be renewed, I can no longer defend the PT I have in place at $70 to $80 by mid-year next.

Thus, I have posited a valuation of LVS finally making some kind of announcement of a move into sports betting that will hearten the confidence of holders and start the stock on an upward climb again.

I think a move in online that made sense and held strong prospects for success ahead for LVS in that space would be bullish enough to ignite entry at its current bargain price based on asset values alone. I say this in full cognizance that the sports betting sector is already overcrowded, its marketing and media a cascading Tower of Promotional Babble. But the LVS brand with strong identification among gamblers for decades supports an entry into the digital space.

I have baked in sports betting and perhaps some positive peeps from Asia and come up with a revised PT of $67 by 2Q22.

That looks like a pretty strong possible return from here.