Post by Blitz on Nov 20, 2024 10:12:38 GMT -5

Marina Bay Sands targeting 40% EBITDA increase once IR2 expansion completed

Kelsey Wilhelm - November 20, 2024

agbrief.com/news/singapore/20/11/2024/marina-bay-sands-targeting-40-percent-ebitda-increase-once-ir2-expansion-completed/

Marina Bay Sands is aiming to create the ‘most valuable tourism development in the world’ with its IR2 (Integrated Resort 2) expansion, targeting a 40 percent increase in adjusted property EBITDA once the project is completed.

According to an investor presentation released on Tuesday, the group is hoping to push its pre-IR2 adjusted property EBITDA from $2.5 billion up to $2.5 billion after IR2 is operational. This comes as the group focuses on Asia’s growing wealth and high-net-worth individuals, focusing on ‘high-value tourism’ to ‘drive growth in our revenues and cash flow in the future’.

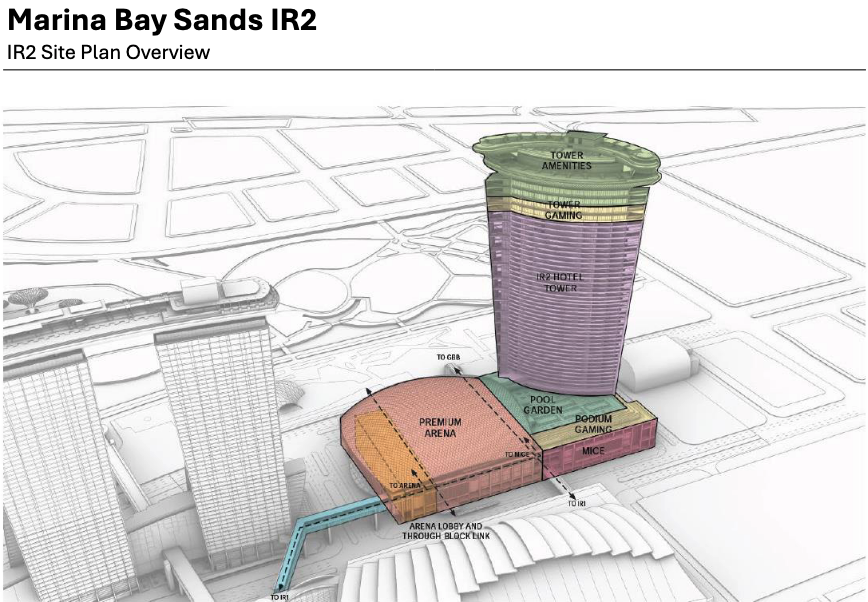

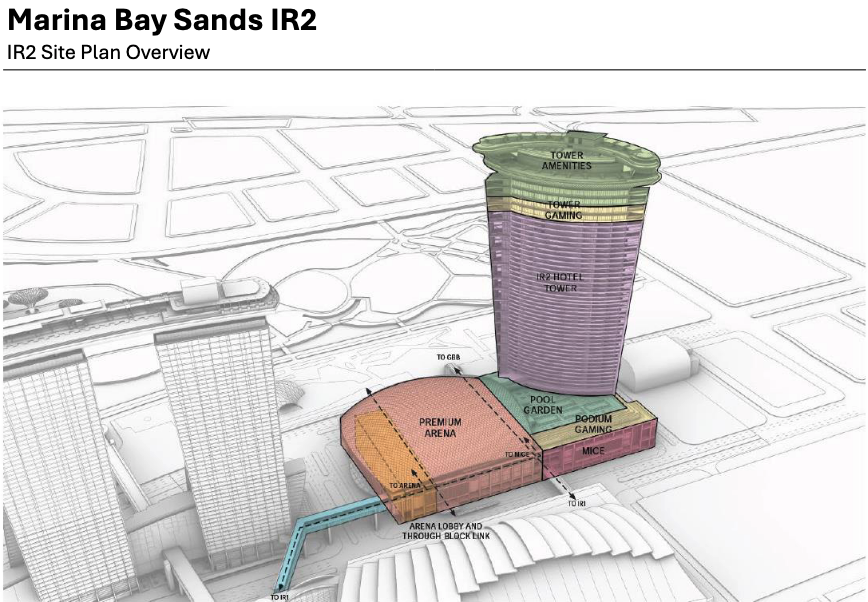

The key features of the addition are the 570-suite ultra-luxury hotel (including 23 ‘signature multi-bay mansions’), 15,000-seat arena and 110,000 square feet of premium MICE facilities, as well as more premium gaming areas.

While the group is contractually obligated to complete IR2 by July of 2029, MBS indicated that ‘the current estimate is that construction will be complete in June 2030 with an anticipated opening date in January 2031’.

It furthers that ‘any extension of the completion date beyond July 2029 is subject to the approval of the Singapore government’. It intends to seek this extension ‘following the commencement of construction and additional contracting and procurement work’.

Breaking down its capital expenditure expectations, for 2025 some $1.2 billion is expected – $1 billion for the land premium and $200 million for capex. For 2026, only $350 million is envisaged, all going to capex. This expands to $400 million in 2027, rising to $1.15 billion in 2028. Capex for IR2 is expected to peak in 2029 at $1.85 billion, falling to $550 million for 2030 and beyond.

In order to facilitate the expansion, MBS is reportedly seeking Singapore’s largest loan facility, at SG$12 billion ($9 billion).

By focusing on higher net worth individuals, MBS plans to further boost its gross gaming revenue share beyond the 54 percent it boasted in 3Q24, as well as its 69 percent share in mass GGR. As of 3Q24, MBS had 74 percent of EBITDA share in the duopoly.

This is boosted by Asia’s most-played table game: baccarat, which has seen a higher rolling hold percentage since the introduction of additional wager variants, such as Tiger Baccarat in 2018 and Dragon Tiger Baccarat in 2024.

The group also aims to improve efficiency and the customer experience by rolling out the Angel Eye Complete Smart Tables across the property, with the ‘dual camera + AI solution’ rolled out across all rolling and premium mass tables mid-this year, with expectations ‘to have the full solution deployed across all tables by end of 2025’.

Kelsey Wilhelm - November 20, 2024

agbrief.com/news/singapore/20/11/2024/marina-bay-sands-targeting-40-percent-ebitda-increase-once-ir2-expansion-completed/

Marina Bay Sands is aiming to create the ‘most valuable tourism development in the world’ with its IR2 (Integrated Resort 2) expansion, targeting a 40 percent increase in adjusted property EBITDA once the project is completed.

According to an investor presentation released on Tuesday, the group is hoping to push its pre-IR2 adjusted property EBITDA from $2.5 billion up to $2.5 billion after IR2 is operational. This comes as the group focuses on Asia’s growing wealth and high-net-worth individuals, focusing on ‘high-value tourism’ to ‘drive growth in our revenues and cash flow in the future’.

The key features of the addition are the 570-suite ultra-luxury hotel (including 23 ‘signature multi-bay mansions’), 15,000-seat arena and 110,000 square feet of premium MICE facilities, as well as more premium gaming areas.

While the group is contractually obligated to complete IR2 by July of 2029, MBS indicated that ‘the current estimate is that construction will be complete in June 2030 with an anticipated opening date in January 2031’.

It furthers that ‘any extension of the completion date beyond July 2029 is subject to the approval of the Singapore government’. It intends to seek this extension ‘following the commencement of construction and additional contracting and procurement work’.

Breaking down its capital expenditure expectations, for 2025 some $1.2 billion is expected – $1 billion for the land premium and $200 million for capex. For 2026, only $350 million is envisaged, all going to capex. This expands to $400 million in 2027, rising to $1.15 billion in 2028. Capex for IR2 is expected to peak in 2029 at $1.85 billion, falling to $550 million for 2030 and beyond.

In order to facilitate the expansion, MBS is reportedly seeking Singapore’s largest loan facility, at SG$12 billion ($9 billion).

By focusing on higher net worth individuals, MBS plans to further boost its gross gaming revenue share beyond the 54 percent it boasted in 3Q24, as well as its 69 percent share in mass GGR. As of 3Q24, MBS had 74 percent of EBITDA share in the duopoly.

This is boosted by Asia’s most-played table game: baccarat, which has seen a higher rolling hold percentage since the introduction of additional wager variants, such as Tiger Baccarat in 2018 and Dragon Tiger Baccarat in 2024.

The group also aims to improve efficiency and the customer experience by rolling out the Angel Eye Complete Smart Tables across the property, with the ‘dual camera + AI solution’ rolled out across all rolling and premium mass tables mid-this year, with expectations ‘to have the full solution deployed across all tables by end of 2025’.